The Middle Class is Cracking

The middle class is cracking, but if you want a statistic that “proves” this, there isn’t one. The cracking isn’t a statistic, it’s the culmination of observations logged over the past 15 years about these critical measures of what it takes to qualify as middle class:

1. How much income a household needs to secure the minimum qualifications of a middle class standard of living / quality of life, based on the conventional standards of the 1960s – 1980s. (The qualifying characteristics are listed below.)

2. The upward or downward mobility of those claiming middle class status. Put another way: if it requires monumental effort and perfect execution to achieve the minimum qualifications of middle class security, then that isn’t a “middle class” set of qualifications, that’s an elite set of qualifications.

3. Precarity: how much (or little) financial disruption does it take to tip a household into a down-spiral that becomes increasingly difficult to escape. The foundation of any non-trivial definition of “middle class” (any definition that is solely based on income is trivial) is the financial resilience offered by ownership of assets, particularly income-producing assets, and savings that can be tapped to handle emergencies.

I’ve been addressing these issues for many years. Here are a few of my posts on the decay of the middle class:

Priced Out of the Middle Class (June 28, 2012)

What Does It Take To Be Middle Class? (December 5, 2013)

Misplaced Pride: Most of the “Middle Class” Is Actually Working Class (June 14, 2019)

Squeezed for Decades, America’s Working Class Is Finally Up Against the Wall (May 13, 2024)

Here are the minimum requirements to qualify as middle class, drawn up by myself and readers:

1. Meaningful healthcare insurance. By meaningful I mean healthcare insurance that doesn’t have high deductibles–if you have to pay thousands of dollars before the insurance kicks in, that’s not insurance, it’s a simulation of insurance–and insurance that isn’t reduced to meaninglessness by limitations on coverage and/or zero coverage for core elements of healthcare.

2. Significant equity (25%-50%) in a home or other real estate.

3. Income/expenses that enable the household to save at least 6% of its net income.

4. Significant retirement funds: 401Ks, IRAs, etc.

5. The ability to service all debt and expenses over the medium-term if one of the primary household wage-earners lose their job.

6. Reliable vehicles for each wage earner.

7. If a household requires government assistance to maintain the family lifestyle, their Middle Class status is in doubt.

8. A percentage of non-paper, non-real estate hard assets such as family heirlooms, precious metals, tools, etc. that can be transferred to the next generation, i.e. generational wealth.

9. Ability to invest in offspring (education, extracurricular clubs/training, etc.).

10. Leisure time devoted to the maintenance of physical/spiritual/mental fitness.

11. Continual accumulation of human and social capital (new skills, networks of collaborators, markets for one’s services, etc.)

12. Family ownership of income-producing assets such as rental properties, bonds, family-owned business, etc.

The absolute scale of these requirements is less important than all twelve being included in the household’s quiver. In other words, it’s not necessary to own equity worth millions, but it is important to own meaningful equity across the range of assets listed above.

Back in 2012, I went through each requirement and arrived at a minimum household income of $106,000– adjusted for inflation, the equivalent sum today is $152,000. Before you scoff, please read the entirety of Michael Green’s careful analysis of what qualifies as “poverty level income” and “middle class income:” How a Broken Benchmark Quietly Broke America (via Cheryl A.)

Green concluded the minimum income needed today is $140,000— more or less the same as my estimate, especially given his detailed explanation of why this minimum is barebones.

Green’s analysis of middle-class precarity dismantles all the statistical rah-rah presented as evidence that we’re all getting richer every day, in every way. Like insurance with stupidly high deductibles, this isn’t middle class security, it’s a simulation of middle class security.

This report in the Wall Street Journal suggests this reality is now so undeniably obvious that the WSJ had to address it: The Middle Class Is Buckling Under Almost Five Years of Persistent Inflation: Workers growing tired of economy in which everything seems to get more expensive.

As Green explained, soaring costs for big-ticket essentials–all the things required to participate in the economy in a meaningful fashion–are crushing the middle class.

Unless you lucked into an early seating for the banquet of wealth served up by The Everything Bubble–then life is good: Feeling Great About the Economy? You Must Own Stocks: Investors’ rosy feelings about their stock market gains are powering spending–but it’s a different story for everyone else.

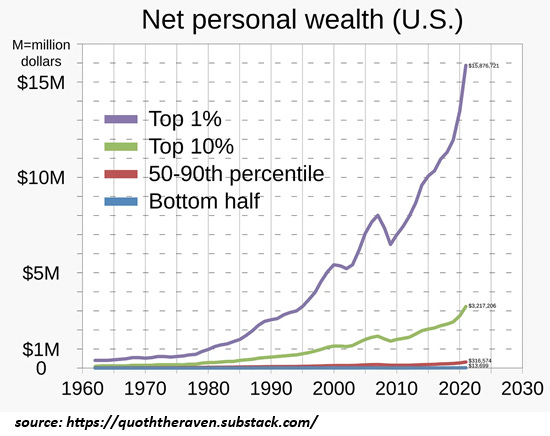

This has generated a generational divide in security/precarity and wealth accumulation: those who bought stocks and housing long ago when they were relatively cheap have piled up wealth not by being more productive, but by becoming early owners of capital that has been goosed by policies seeking to boost spending via “the wealth effect.”

That this bubble-generated wealth flowed predominantly to older households with incomes that enabled asset purchases effectively made the rich richer. Those without these advantages lost ground, and absent the cushion of wealth piled up by The Everything Bubble, their claim to middle-class security is more a simulation than the real thing.

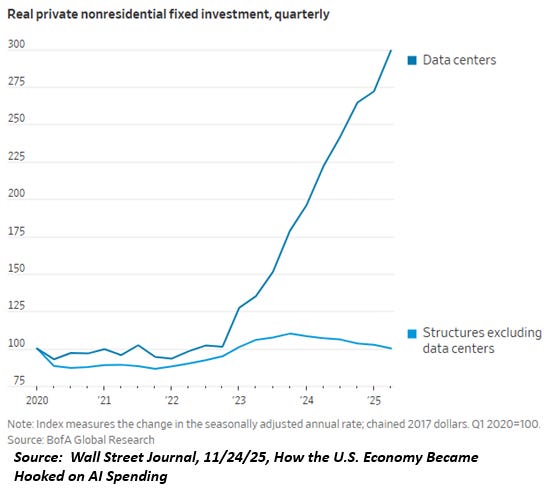

The middle class is cracking, and the Everything Bubble hasn’t even started to pop yet; once it does, job losses will accelerate due to the self-reinforcing nature of job losses reducing income and spending which then triggers more job cuts. How the U.S. Economy Became Hooked on AI Spending: Growth has been bolstered by data-center investment and stock-market wealth. A reversal could raise the risk of recession.

This chart illustrates the reality: the already-wealthy have pulled away as financialization, globalization, precarity and inflation gutted the middle class.

The solidity and economic dominance of the US middle-class is illusory. The middle class is cracking, and borrowing more to maintain spending is hanging on by one’s fingernails, not middle-class security.

https://charleshughsmith.substack.com/p/the-middle-class-is-cracking