Hobson’s Choice: Depression or Revolution

Both of these bubble characteristics set up our illusion of choice.

Hobson’s Choice is the illusion of choice, when the only real choice is “that or none”–”something or nothing.” We now face a Hobson’s Choice between a Bubble Economy that leads to Revolution, or we pop the Bubble Economy and get a Depression.

Put another way, there is no alternative in the status quo to a Bubble Economy which leads to Depression or Revolution.

We can choose “something”–a bubble-dependent economy–or nothing, as there is no alternative in what analyst Tim Morgan (Surplus Energy Economics) calls the Post-Capitalist Expediency (PCE) economy because it’s based not on capitalism but on monetary and policy expediencies.

If we choose the Bubble Economy, it ends in Depression or Revolution. If we choose “none”–pop the Bubble Economy–we still get Depression or Revolution, and those come as a inextricably bound pair: the only choice is which come first. So the choice between Depression or Revolution is also illusory.

The temptation here is to distract ourselves with debates that lead to quicksand: rather than illuminate the issue, they bog us down.

The temptation arises because the facts are inconvenient to the conventional narrative of Permanent Progress and Plenty for all–the three Ps.

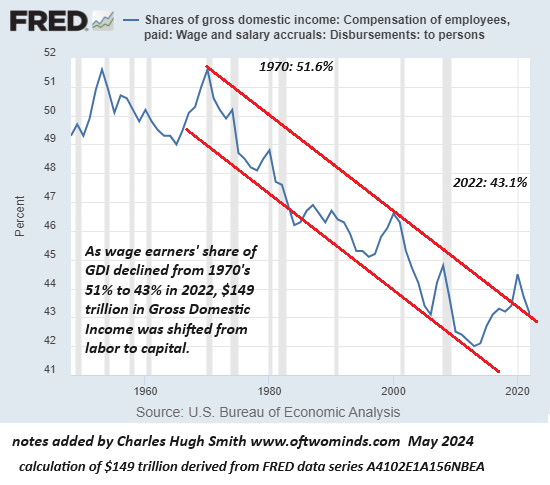

Over the past 50 years, the share of the economy being distributed to wages has shrunk while the share distributed to capital has increased. Over these five decades, the cumulative difference now exceeds $150 trillion.

The net result is those who own capital have gained fortunes while those who depend on earnings from their labor have lost ground. The “Plenty” has been asymmetrically distributed to the benefit of capital.

At the same time, costs have risen inexorably for the essentials required to participate in the economy. These essentials have become increasingly complex and burdensome. In 1975, at the peak of labor’s share of the economy, one could function as a full participant in the economy with 1) a landline telephone, 2) a mailing address, 3) a bank checking account and 4) one credit or debit card.

The fees to maintain these essentials were modest.

To function as a full participant in the economy now requires constant expenditures on technologies and an immense amount of shadow work to manage the complexity. At the same time, the costs of essential services such as childcare, higher education and healthcare have exploded when measured in the number of hours of labor required to pay for them.

As I have repeatedly explained, this is the only valid metric of costs: the number of hours of labor required to pay rent, insurance, tuition, etc., i.e. the purchasing power of labor. Every other measure is artifice that is easily gamed to create an illusion of “Plenty.” Generating this artifice is the primary task of conventional economists.

The sources of this inexorable rise in the cost of living are many–bureaucratic bloat, the expansion of unproductive complexity, and so on–but the primary driver is the suppression of competition and transparency by monopolies and cartels: once these structures dominate a sector, they are free to increase profits by raising prices and degrading the quality and quantity of their products/services.

The rising costs of essentials is self-reinforcing: soaring healthcare costs increase the overhead costs for employers to have employees, increasing the pressure to replace workers with technology or game the system to avoid having to insure their workers, a trend that increases the precarity of the uninsured workforce.

The economy is now dominated by these self-reinforcing feedback loops of cartels and monopolies–both private-sector and state, as state agencies continually increase mandatory fees.

As I explain in Investing In Revolution, totalitarian governments and corporate monopolies are structurally identical.

Since the status quo is dominated by those who own capital, this widening asymmetry between labor and capital serves their interests remarkably well. They have no incentive to reverse it and every incentive to increase it.

If this widening asymmetry were to become painfully visible, this would threaten the stability of the status quo. And so Job #1 for the Powers That Be is to cloak this reality with 1) artificially contrived statistics, 2) credit and 3) asset bubbles.

To fill the widening gap between the purchasing power of wages and systemically rising costs of essentials, the status quo has expanded credit much like a star going supernova: credit has consumed the entire economy.

Since earnings don’t cover expenses, the “solution” is to borrow money. This is an ideal “solution” for those who own capital, as the debt is an asset that generates income.

That debt slowly impoverishes the debtors is glossed over by the artifice of “investment”: borrowing $100,000 to pay for a university degree of diminishing (or near-zero) value is an “investment,” exorbitant childcare is an “investment,” and gambling in the stock market / real estate casinos is of course an “investment.”

But there are limits are using credit to fill the widening gap between wages and essential expenses, and so the third “solution” is to inflate an asset bubble with central bank monetary stimulus and regulatory hocus-pocus.

There are two key characteristics of credit-asset bubbles:

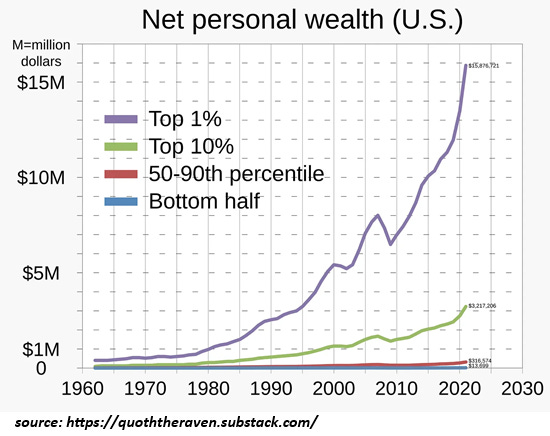

1. They inherently favor those who already own assets and those with access to lower-cost credit, i.e. the high earning already-wealthy, and

2) They don’t actually address the fundamental problems with our asymmetric economy, they simply paper them over with a floodtide of phantom wealth.

The wealth generated by asset bubbles is phantom because the utility-value of the assets doesn’t increase; the only thing that soars is the market value within an artificially controlled monetary system: think Monetary Mouse Utopia. (Musings Report #48: Red Friday, Mouse Utopia and Model Collapse).

Simply put, the entire structure of asset bubbles–monetary manipulation / stimulus, expanding credit, the funneling of credit into expanding bubbles–is a hallucination that like AI hallucinations, is constantly reinforced by the financial system “training” its analysis on its previous hallucinations of artificial wealth.

Both of these bubble characteristics–the phantom wealth flows to the already wealthy, pushing wealth / income inequality to extremes, and the synthetic illusion that “money” can painlessly solve all structural problems–set up our illusion of choice:

1. If the bubble continues expanding, the extremes of wealth / income inequality will trigger revolution.

2. If the bubble continues expanding, the extremes generate instabilities that inevitably implode the bubble.

To take but one example of many, due to the asymmetries built into bubble-dependent economies, the top 10% now account for half of all consumer spending and collect 40% of all income. the top 0.1% who own a preponderance of income-producing assets collect the majority of unearned income / income from assets.

This dependence on soaring asset valuations to generate “the wealth effect” while pushing inequality to extremes is self-liquidating: it generates its own collapse.

Should the bubble pop due to its own extremes and instability, the resulting collapse in consumption and the reversal of ‘the wealth effect” will crush the economy as jobs will be shed in a self-reinforcing feedback loop: as consumption plummets, job losses mount, reducing household income which then further reduces consumption.

Since the state (dominated by those who own assets) has papered over these asymmetries by borrowing tens of trillions of dollars, the state’s ability to “print our way to prosperity” is limited.

Those claiming that the “solution” is to eliminate paying interest on state debt and just print as much money as we need to keep things glued together–Modern Monetary Theory--have fallen into the “money solves every problem” trap: the fundamental sources of the self-liquidating asymmetries are not resolved by distributing freshly printed money.

“Money” doesn’t solve structural, systemic asymmetries, it simply enables their further expansion. “Money” in whatever form we choose doesn’t reverse moral decay, either, as those at the top of the wealth-power pyramid will quickly gain control of the new “money” and use it to their own advantage.

If the bubble continues expanding, this will eventually trigger a social revolution that disrupts the hallucination of monetary stimulus / credit / asset bubbles, crashing the economy into Depression.

So take your pick, but the results will be the same: Depression or Revolution. the only “choice” is which comes first.

https://charleshughsmith.substack.com/p/hobsons-choice-depression-or-revolution