Is This the Last Bubble?

There are four dynamics that define the entire socio-economic-cultural-political system.

To answer the question, is the Everything/AI bubble the last one, we need to start with an even larger question: has the current system reached its limits? If so, reforms–regardless of their nature–won’t save it.

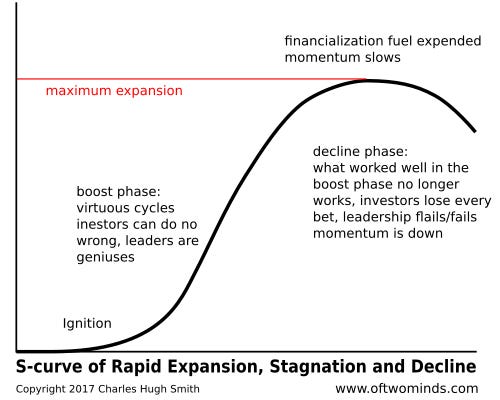

The context here is the way that socio-economic-cultural-political systems arise as problem-solving arrangements that work remarkably well–the boost phase of the S-Curve–reach their peak of efficacy–the top of the S-Curve– and then solidify into sclerosis–the stagnation-decline phase– where “doing more of what’s failed” is normalized.

This is so gradual that those living through the cycle don’t notice the sclerosis and stagnation, as each wave of expanding past solutions seems to work because the systemic costs are hidden by the vast machinery grinding away in a show of functionality and permanence.

The problem is all this whirring of the gearing is now for show, and this gradual replacement of inspirational values by going through the motions is now normalized: few have any memory of a system that wasn’t thoroughly corrupted by artifice and spectacle– going through the motions of reform that doesn’t actually change any of the system’s gearing. As a result, this performance of reform is taken as “real.”

But because it’s all a performance (signing of documents, grand declarations, etc.), nothing fundamentally changes, and so people turn from one group of political performers to another, increasingly frustrated by the widening divide between the grandiose declarations and the lived reality of soaring costs and precarity and declining quality of life.

There are four dynamics that define the entire socio-economic-cultural-political system, whatever we call it:

1. The Waste Is Growth Landfill Economy, a.k.a. “abundance”

2. The declining share of economic output/wealth distributed to wages/earnings and the corresponding rise in the share distributed to capital (asset owners, unearned income)

3. The increasing dependence of the economy on credit-asset bubbles generating “the wealth effect” and “trickle-down economics’

4. The substitution of borrowed money (debt) for earnings / revenues.

I’ve often described these dynamics, so we’ll stick to shorthand.

1. Waste isn’t growth, it’s waste, but waste (and monopoly enforcing the waste) are the most profitable arrangements, so they’ve come to dominate our system and our assumptions: if we stop “growing” (by wasting more) then everything collapses.

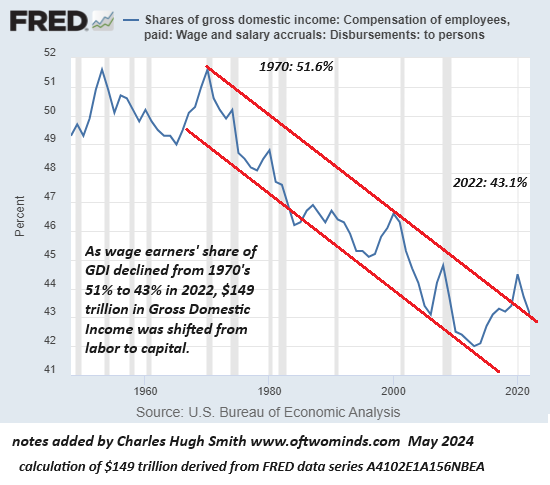

2. Since wages’ share of economic output peaked in the mid-1970s, $150 trillion has been siphoned from wages and transferred to capital. This transfer has been one systemic cause of the current extremes of income/wealth inequality.

3. The policy responses to the 2008 Global Financial Crisis (that was the direct result of systemic financial fraud) subtly shifted the economy from what is called organic growth to dependence on credit-asset bubbles that enrich the top 10% who received an early seating at the Bubble Banquet.

The policy idea here is that this vast expansion of asset valuations generates “wealth” (not by increasing productivity or functionality, but by monetary stimulus) that will “trickle down” to those who didn’t get the benefits of an early seating at the Bubble Banquet.

The problem is “trickle-down” is just another financial fraud: the share of the bottom 50%’s ownership of financial assets has actually declined since 2008.

4. As economic “growth” depended on monetary stimulus and the expansion of credit, the stagnation of wages led to households borrowing to fill the gap opening between stagnant wages and rising costs of living.

Institutions and monopolies (higher education, et al.) exploited this expansion of credit to feast on those herded into debt-serfdom.

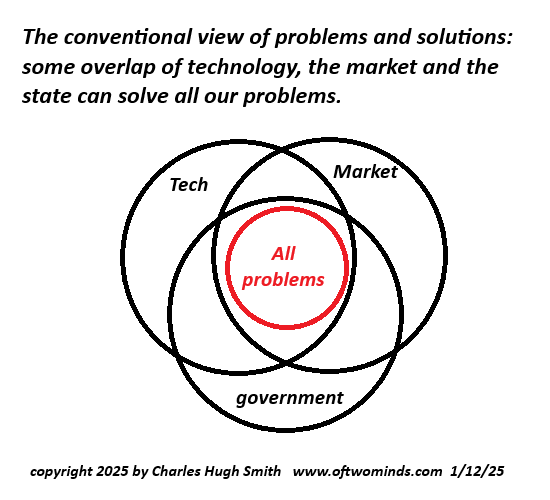

None of the conventional “reforms”–political, market or technological–change any of these dynamics. But in the conventional telling, all problems are solved by some overlap of tech, markets and government:

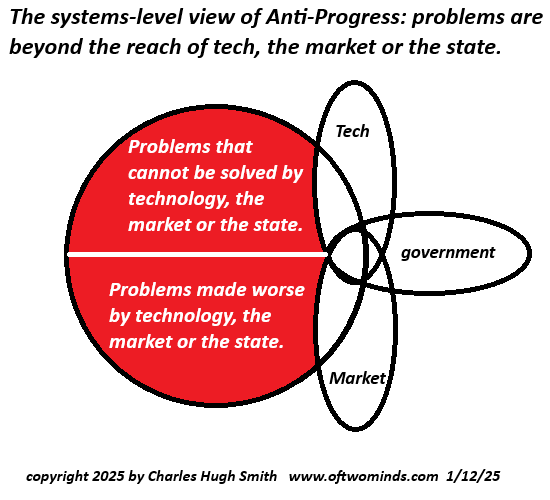

Since the problems are far deeper than the superficial churn–the mythology / values / systems have failed–none of these “solutions” actually change any of these four dynamics in any structural, meaningful way.

As a result, we inhabit a live-action parody of “solutions” and “opportunities”: the “solution” to not having enough money to pay this month’s rent and utility bills is an “opportunity” for capital: loan those with poor credit but “equity” in their used car/pickup money at 30% interest.

This live-action parody of “solutions” and “opportunities” has now been normalized throughout the system, with the AI euphoria/bubble being the primary stage of the parody performance.

I understand many believe that the system can inflate serial bubbles forever, and so when the Everything/AI Bubble pops, another will quickly replace it.

As a counterpoint to this confidence–a confidence supported by the system’s track record of successfully inflating one bubble after another for 30 years–I submit that the system has reached its limits and will be unable to inflate a fourth bubble after the Everything/AI Bubble pops.

This boils down to the limits of substituting performances and live-action parodies for actual solutions that radically transform the four dynamics listed above. This means that all the conventional expectations–of serial bubbles further enriching the already-rich, of soaring inflation eating away both the debt and the quality of life, etc.–may be based on faulty premises.

The system has reached its limits, and cracks will appear throughout the system. Since these cracks are interconnected, the system is entering a nonlinear, emergent state where linear predictions based on the past are no longer accurate.

Author Ray Huang’s summary of the Ming Dynasty before its final collapse apply to the present day:

“It is evident by that time the limit for the Ming dynasty had already been reached. It no longer mattered whether the ruler was conscientious or irresponsible, whether his chief counselor was enterprising or conformist, whether the generals were resourceful or incompetent, whether the civil officials were honest or corrupt, or whether the leading thinkers were radicals or conservatives–in the end they all failed to reach fulfillment.”

https://charleshughsmith.substack.com/p/is-this-the-last-bubble-224