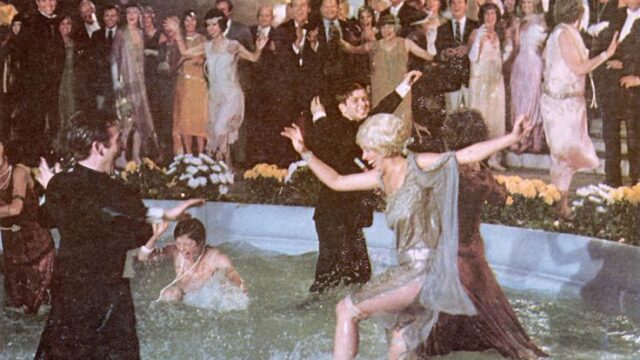

Roaring 20s or Great Depression 2.0?

Why is the next decade a binary of extremes rather than another period of “muddle through”? The short answer: Cycles. Take your pick: the Fourth Turning, the Kondratieff credit cycle, Peter Turchin’s 50-year cycle, the Debt Supercycle, and a host of others–they’re all hitting their inflection points now.

If you dismiss all the cycles, fine. Just look at the political, social and economic state of the world, and you reach the same conclusion: a major historical inflection point in in play. While President Trump’s policies are drawing all the media attention, Gordon and I break it all down to three defining systemic dynamics:

1. America’s great wealth-income divides, i.e. the winners and losers of financialization and globalization: rural / urban, Main Street / Wall Street and the generational divide.

2. The allocation of capital: creative destruction vs monopoly / cartels. How will the nation’s capital be invested? Will it be squandered in malinvestment that serves the interests of private equity, or will it be invested to serve national interests?

3. DOGE and entrenched interests’ resistance to change: government over-reach, unlimited deficit spending and the decay of accountability do not serve the common good, yet these excesses benefit powerful entrenched interests who will pull out all the stops to defend their slice of the pie.

As I have often noted, the past 40 years can be understood as the Age of Hyper-Financialization and Hyper-Globalization, as these forces have come to dominate the America’s economic, political and social landscapes. Financialization and globalization are not neutral forces: they generate winners and losers, and a deep gulf between the two extremes.

Coastal urban regions have been the nig winners, rural America has been the big loser. Wall Street has been the big winner, and Main Street the big loser. The Boomer Generation that bought stocks and housing when they were affordable to the majority have been the big winners as these assets have soared in credit-asset bubbles, and the generations priced out of these assets have been the big losers.

Monopolies and cartels have been the big winners, to the detriment of everyone else. The crapification of goods and services and the rise of precarity has enriched monopolies, cartels and private equity, at the expense of the rest of us.

Will the nation’s capital be invested in the common good and the citizenry, or will it serve the interests of private equity? The heavily promoted fantasy is that enriching private equity magically serves the common good and the citizenry, but the decline of the nation’s health and security speak to the reality that self-enrichment is not the same as investing in the citizenry and their interests.

The core requirement of good governance are: 1) transparency 2) accountability 3) prudent borrowing/spending and 4) limits on over-reach. That each of these are in need of improvement is undeniable, and resistance comes in two flavors: those with different ideas of reform and those resisting any diminishment of their power and share of the state’s largesse.

The binary ahead is the result of a simple law of Nature: adapt or die. Clinging on to whatever serves the interests of those benefiting from the current arrangement can be sold as “change,” but this isn’t adapting, it’s maladaptation on a systemic scale. Whether we get the Roaring 20s or the Great Depression 2.0 boils down to this:

Are we adapting via real transformations, or are we controlling the narrative to protect those benefiting from the status quo? Stay tuned.

https://charleshughsmith.substack.com/p/roaring-20s-or-great-depression-20