Sundown on the Potemkin Empire

Trump made waves this week with his major economic subjugation of Europe on the announcement of his 15% tariffs, made before a stooped and servile Ursula von der Leyen. But as with everything which pours forth from the Trump administration’s victory fountain there are finer nuances worth a closer examination.

Hat tip to resident analyst

William Schryver for alerting us to the recent piece by a fellow Substacker who devised a compelling argument for why Trump’s major ‘EU coup’ may have in fact been nothing more than another oversold goose egg:

Full disclosure: there are many ways to think about this, and many who disagree with this particular angle—but it’s worth a consideration nonetheless. The fact that we even have to argue whether such “massive boons” are having any restorative effect on the US, I suppose, is a bad sign in and of itself: constant trumpeting of astronomical figures—hundreds of billions saved by DOGE here! Another twelve-figure batch pocketed by tariffs there!—never quite directly translates into anything tangible. Of course, it’s all yet young and we must allow more time for such things to structurally percolate, but the years of hollow victory bells have exhausted all of us.

Powell begins his exegesis with a declaration I agree with: that perception matters more than reality, more than ever today in our increasingly ‘simulated world’, where money and economies themselves are nothing more than grossly over-counted hyper-leveraged debt-and-fiat instruments.

He goes on to argue that Trump’s unprecedented ‘coup’ over abject Ursula was actually a European triumph over the easily-cajoled nectarine narcissist.

But look beneath the bombast, and a different picture emerges. The picture is paradoxically not of European weakness per se (or vassalage as self-loathing Europeans would be tempted to say), but of European entrapment strategy from a position of relative weakness. If anything, this “deal” locks the United States deeper into Europe’s security and economic architecture, not the other way around. And it does so by using the one thing Trump cannot resist: the illusion of winning.

His reasoning is that virtually all the keystone promises of the deal are phony or impossible to fulfill—this includes the $600B in European investment in the US, $750B in US LNG purchases, and the like. The headline 15% tariff deal likewise is disregarded as impotent for a clever reason: the percentage is not quite high enough to trigger production line relocations, for instance back to the US, but is just high enough to essentially saddle everyone with higher prices and more debt, without really affecting any desired structural economic changes for the benefit of the American people. Mr. Powell calls it “the worst of both worlds”:

[I]t imposes frictional costs on the U.S. economy without achieving any structural shift in the geography of production. Put plainly 15% is painful enough to hurt enterprises and households, but not painful enough to change production location decisions.

Quick note: some argue the 15% is low enough where the importers will be paying it rather than the consumer—but this is a kind of amateur understanding, if one really thinks the buck will not be passed along in some way. The importing companies have many tricks by which they can pretend to eat the cost yet still recoup it from the consumer—for instance, they’ll simply ‘shrinkflate’ some other unrelated domestic product to balance out the losses. And even if they didn’t, these are still American companies, which has long-term compounding economic effects on the country as a whole, which transfers to the consumer down the line.

Opiate for the masses: Shylock-in-chief and resident Tariff Circus Barker says the EU will “pay the tariffs”—lies so glabrous they smile back at you!:

One might argue: but these “higher prices” and consumer pains are balanced by the EU’s promise of monumental investment in the US economy with the aforementioned trillions in LNG and other so-called purchases. The problem is, these figures appear made out of thin air in the same now-popular practice so regularly witnessed in Ukraine: where for instance Patriot missiles were promised only to have Germany and others subsequently squabble over who’s paying for what or how.

Similarly here, Powell argues that $750B in LNG purchases over three years is laughable owing to the naked math of it all:

Let’s start with the most audacious number: $750 billion in LNG purchases over three years. In 2024, the EU imported roughly 45 billion cubic meters (bcm) of U.S. LNG, valued at about $16–19 billion. In the first half of 2025 alone, it took in another 46.5 bcm, on track for nearly 93 bcm for the full year; that’s roughly $33–39 billion, assuming market prices of $10–12/MMBtu.

In short, the EU would need to increase both volume and/or price more than six-fold to hit the $250 billion annual target. This is not remotely feasible.

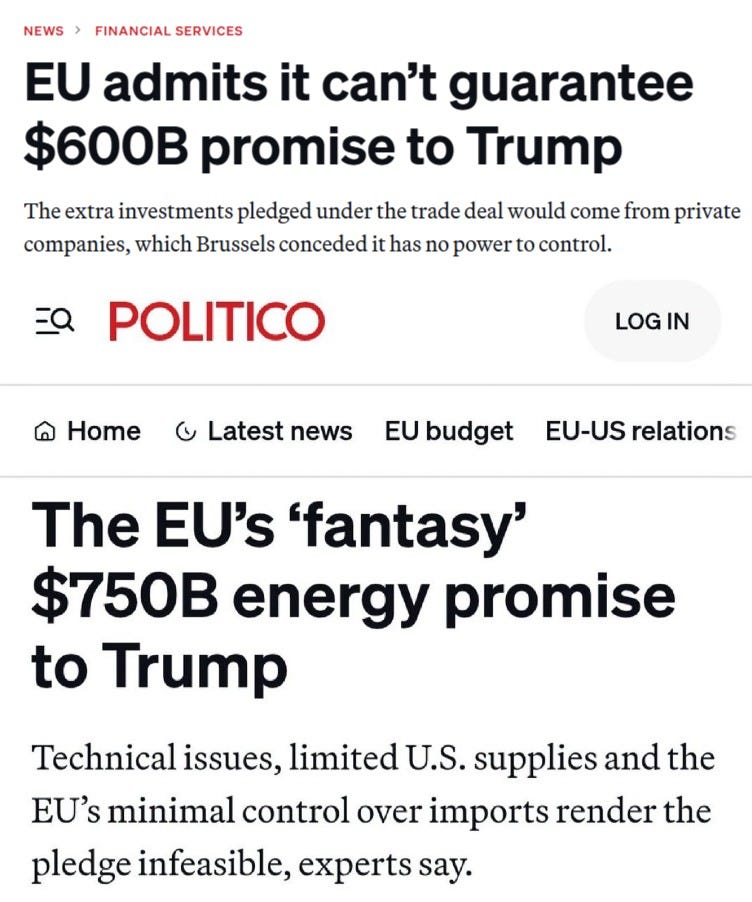

A mere day later, this view was vindicated by several mainstream powerhouses:

After pledging to invest $600 billion in the US economy, the EU admitted it doesn’t have the power to follow through. That’s because the money is planned to come exclusively from private sector investment — which Brussels has no authority over.

The article above explains that the EU commission already admitted mere hours after the “huge deal” was signed that the promised investment is to come from private corporations which have had no incentives offered to them for such a thing, which means the entire charade is nothing more than another empty show of ‘wishful thinking’, meant to glaze us with a brief PR tableau.

But the idea that the private sector can be relied upon to provide that level of investment was met with skepticism.

“This part of the deal is largely performative,” Nils Redeker from the Jacques Delors Centre think tank told POLITICO. “[The EU] is not China, right? So nobody can tell private companies how much they invest in the U.S.”

These days, virtually all foreign policy is conducted in this way. The tempo of our hyper-connected digital times has facilitated a kind of simulacrum where no exaggeration, lie, or absurdity is too great so long as it can be quickly flushed away by an even greater one. If one isn’t available, the mainstream media magicians are tasked with waving their hands over some new ‘crisis’ or ‘outrage’ to cover the tracks of whatever needs to be forgotten.

But why, you ask, does Powell ultimately reach the conclusion that the deal is not merely a hologram, but on the contrary a cunning triumph by the decaying Europeans? The answer lies in a compelling thesis that the Maggot Queen’s chief objective was to ensnare Trump and the US in Europe’s politics and the Euro-deep state’s Forever War. He concludes:

By offering inflated figures, headline-making numbers, and “big wins,” the EU ensures that:

- The U.S. defence industry is financially bound to Europe;

- The U.S. energy sector is locked into Europe but with limited capacity to actually deliver on the stated numbers, which means European buyers are back on the market anyway;

- The U.S. financial system continues to absorb European capital, which is only a function of persistent European trade surpluses vis-a-vis the US; and

- Any attempt by the U.S. to reduce its European footprint would now come at an enormous domestic economic cost.

In effect, Europe has engineered strategic entanglement for the U.S. in European security affairs under the guise of submission. Trump thinks he’s winning, but the structural reality is that the U.S. is being burdened with more responsibility, more expectations and more economic exposure.

Now, perhaps the above conclusion is a tad oversold for dramatic effect. Without truly crunching the economic figures in a more thorough way it’s uncertain just how ‘cunning’ or deliberate this European twist really is. But it’s true that under the guise of giving Trump’s ego a much needed economic arm-shot, Europe managed to at least maneuver him into perpetually supporting the European MIC and by extension the Ukraine war. This is not a European victory, per se—it is a grave disaster for the futures of average European citizens—but it is a victory for the Euro-deep state, the Brussels and London cabals controlled by generational private finance, the bankster clan which must hold power at all costs and cannot allow a rival system to emerge on the global stage, much less their doorstep.

Another proposed view:

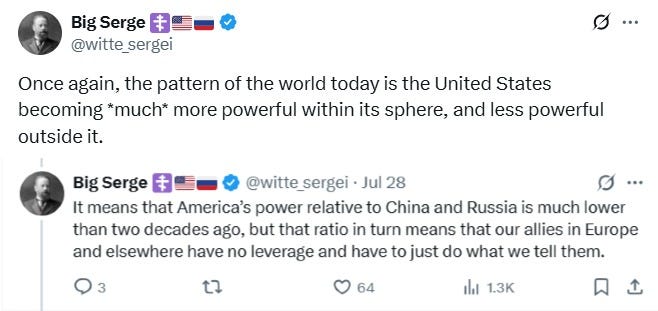

As stated above, it can be argued that what we’re seeing is a self-assembly process wherein the inevitable factionalization of the post-globalist world—one based on the ‘open society’ model—is taking place. And the US, knowing it can no longer control this process, nor dominate the newly-rising factions, has simply resigned to carving the world into spheres and engineering a renewed domination of its own sphere as a kind of consolation prize. It is a necessary tactic of retreat: if we can’t be masters of the world, we’ll at least be full masters of our half of it.

Another thought-provoking view on developments was voiced by a French analyst:

A few random thoughts on the deal:

-After a “happy globalisation” phase, the EU risks entering “happy vassalisation” phase. The US went from being a “benign” liege lord to a much more aggressive one.

-And yet for the political embarrassment it remains to be seen if this all too bad economically. 15% is bad but I suspect a large part will be paid by US consumers due to inelasticity. Alternative global producers are also tariffed anyways

-Trump loves his “old” US industries. What is he excited for? For EU consumers to buy pickups and SUVs. Really not the industries of the 21st centuries. I highly doubt there’s a massive market for these oversized and costly monstertrucks. Suspect that even heavily tarriffed chinese EVs will be much better fits.

-The devil is in the details. This is only a political agreement, the multi-billion stuff on energy and weapons I’m curious to see in practice because the EU can’t impose member-states to buy US energy or guns. Just look at the recent deal with Japan.

He too suspects much of the deal is questionable, merely grist for the PR mill. The entire globalist charade at this point consists of presenting an image of solidarity, growth, and ‘optimism’—a narcotic psyop for the masses drowning in the post-modernist hell of social and cultural breakdown. Think of these deals as nothing more than kabuki theater aimed at concealing the massive printing of central bank debt meant to prop up the disintegrating system a little while longer. At this point, the elite cabal’s only remaining mandate is to conceal the disrepair and present an air of ‘health’ and systemic structural integrity—nothing else matters to them; but the charade no longer fools us.

Granted, what Trump is doing is still head and shoulders above the decrepit Biden regime’s lifeless pantomime. From the perspective of the US, Trump is at least attempting something radical, rather than the same old hyper-progressive Keynesian Malthusianism. But at the same time, the increasing vapidity of each new ‘victory’ can only be interpreted as a dead cat bounce theory of the US’ terminal imperial decline. All the pomp and glory associated with Trump’s ‘triumphant’ return to the throne seems to be a kind of last gasp from the stiffening cadaver: everything we see rings hollow, every initiative superficial and short-lived; the thin gold leaf veneer is flaking off to reveal weathered vinyl.

This translates to the combined ‘victories’ of the Euro-American Atlanticist sphere. We’re barraged with daily proclamations of bold new initiatives dressed up with pomp and frills, but nothing concrete is ever done: lives never improve and infrastructure stays rotting. Meanwhile, the East sees tangible growth as new cities sprout from deserts, and every week brings announcements of some new engineering marvel topping out, as was the case last month when India unveiled the Chenab rail bridge, now the highest rail and arch bridge in the world:

Or just last week when China broke ground on its own mind-boggling megaproject: the Motuo Hydropower dam, which is to be the world’s largest and most powerful hydropower station, dwarfing even the Three Gorges dam by an unfathomable three-fold increase in power.

Meanwhile, both Trump and Biden—years ago—announced their own trillion dollar plus infrastructure megaprojects meant to transform America, neither of which went anywhere or built anything. This is the dead cat bounce: there’s nothing left but a few last bony boasts and pilfered promises, while the Silicon Valley vultures pick off the last remains from the cadaver.

The only ray of hope, at least in regard to the topic of tariffs, is the following: the overall tariff plan was never really meant to be an isolated cash grab, but rather the beginning of a structural re-engineering of the entire financial system—with first the US and, presumably, the rest of the world, as consequence. This is evidenced by Trump’s repeated invocations of nineteenth-century US, and his desire to replace the income tax with tariffs.

As such, we shouldn’t necessarily mock and judge each individual tariff transaction on its own merit, but rather give time for the broader arc of the long-term plan to play out. Maybe there is hope that something in the system will be rejigged by the gradual implementation of this new—or rather, reenvisioned—paradigm. But ultimately, one cannot escape the feeling that, even despite hopes for a broader global restructuring, any benefits that come will too represent nothing more than the dead cat’s final feeble bounce. The systemic undergirdings prevalent in the nineteenth and early twentieth centuries are simply not in place anymore, and the monstrosity of global finance and capital which has grown since the post-war era likely cannot be undone with even these far-looking and well-intentioned half-measures.

At this point, the only transformational certainty lies in the rise of a rival system in the East, which will eventually lead to the demise of the one operated by the Old Nobility. The only problem: it is impossible for them to go down without a fight, and they will have to trigger major war in preservation of their waning hegemony.

https://simplicius76.substack.com/p/sundown-on-the-potemkin-empire-trumps