The Rearrangement of the Global Economic Order

It was a tremor that shook the financial markets in the trading days following Liberation Day, when tariffs were imposed on almost every country in the world. One of the big winners was gold. After a brief setback below USD 3,000, the USD 3,200 mark was broken on April 11, the USD 3,300 mark on April 16, marking new all-time highs. However, the significant depreciation of the US dollar – the US dollar index fell by around 4% within a few days, by more than 4% against the euro and by around 8% against the Swiss franc – meant that the gold price in euro rose only slightly and fell by more than 4% in Swiss francs. By way of comparison, the S&P 500 dropped by more than 7%.

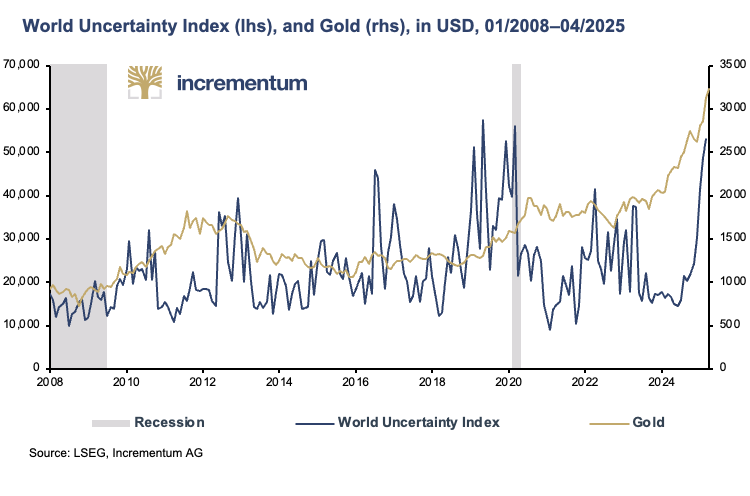

One reason for gold’s strength is its portfolio property as a hedge against (economic) political uncertainties of any kind, whether due to armed conflicts, political crises or trade conflicts. The positive correlation between the gold price in US dollars and the World Uncertainty Index is evident.

Another reason is the express wish of Donald Trump and his administration to significantly weaken the US dollar. The prevailing view in the US administration is that a strong US dollar is detrimental to the US economy. However, the former Deutschmark bloc around Germany and Switzerland, the latter still today, show that this argument does not stand up to reality. Regardless of this, the US dollar should be significantly devalued and, in conjunction with the tariffs, force the reindustrialization of the US – in line with the America First policy.

In addition, a possible Mar-a-Lago Accord is making the rounds, in reference to the two major currency agreements in the 1980s, the Plaza Accord (1985) and the Louvre Accord (1987). Both agreements led to a devaluation of the US dollar. The US current account improved at the time, but remained clearly in the red. A significant reduction was only achieved after the Louvre Accord, and in 1991, a slight surplus was even achieved on one occasion. After that, the US current account balance turned clearly negative again. The aim of the Louvre Accord was, however, to stop the depreciation of the US dollar and keep the exchange rates of the leading industrialized nations within a target corridor. The exact structure of the target corridors was agreed upon in an additional protocol that was never published.

The “improvement” in the current account balance desired by the Trump administration, i.e. the reduction of the current account deficit, would inevitably lead to lower capital flows into the US. Demand for US financial securities, both equities and bonds, would fall, and prices would fall with it.

The US discovers its gold treasure

In the course of discussions about the domestic and foreign policy, economic and trade policy reorganization desired by Trump and his administration, the idea has been floated that the US could raise its considerable gold reserves. Currently, the gold reserves held by the US Treasury are shown on the Federal Reserve’s balance sheet as a gold certificate at a value of just USD 42.22 per ounce. This was the value of an ounce of gold in 1973 after the last official devaluation of the US dollar against gold. With a revaluation to the current gold price of around USD 3,000, the US could raise around USD 800 billion in a one-off transaction, as Switzerland did in 2000, when the Swiss National Bank (SNB) realized a revaluation gain of CHF 28bn as part of a revaluation of its gold holdings, which was distributed to the cantons and used for tax cuts, some of which were substantial. However, Finance Minister Scott Bessent has already taken the wind out of the sails of these rumors.

Notwithstanding the rejection, the role of gold as a reputable and valuable asset is becoming increasingly important. Gold is gradually moving away from its previous underdog role, especially because long-serving safe anchors such as government bonds, in particular, US Treasuries and German Bunds, in particular, are coming under increasing pressure, largely through their own fault.

Judy Shelton’s proposal of gold-backed government bonds

Another possible use for the US gold treasure comes from Judy Shelton. Many years ago, Judy Shelton, who is seen as a possible successor to Jerome Powell, whose term ends in 2026, presented her plan for a gold-backed government bond. The plan is simple and includes two main components: gold convertibility and the revaluation of the US’s current gold reserves mentioned above. Selected US Treasury emissions with a 50-year term, for example, would include an option for the bondholder to redeem the bond for a predetermined amount of gold per USD 1,000 face value in gold.

Regardless of whether this plan is implemented or not. It is further proof that gold is seen as a serious asset for solving serious economic problems.

Germany says goodbye to fiscal virtue

With his abdication as the self-proclaimed “King of debt”, Donald Trump first surprised us with his words and then, with the appointment of DOGE under Elon Musk, with his actions. In view of the current deficit figures, it seems difficult to imagine whether the goal of reducing Washington’s deficit to 3% by 2028, as set out in the “3-3-3 plan” by the current US Treasury Secretary Scott Bessent, is realistic. In the first half of the new fiscal year (10/2024-03/2025), the US budget was once again in deep red territory. The deficit amounted to USD 1.3 trillion and was therefore more than 20% higher than in the previous year, particularly because spending increased by almost 10%.

Apart from the two COVID-19 years, 2020 and 2021, the US could have a budget deficit of more than USD 2 trillion for the first time. USD for the first time. With a projected deficit of USD 1.9 trillion or 6.2% of GDP for the fiscal year ending in September, the CBO’s current forecast is only slightly below this negative threshold. By way of comparison, it has been in the red by a considerable 3.8% on average over the last 50 years. The alarming financial situation of the US federal budget is illustrated by the fact that in February, at USD 306bn, the deficit was higher than Washington’s revenues of USD 296bn. In other words, 51% of all spending in February was debt-financed.

Germany abandons fiscal virtue

Equally surprising, albeit in the opposite direction, was the U-turn by Friedrich Merz, winner of the Bundestag elections and now Germany’s next Chancellor designate. With a double whammy, Germany departed from the path of fiscal virtue. A new special fund, which would be better described as special debt, amounting to EUR 500bn, of which EUR 100bn is earmarked for mandatory climate protection measures, and the easing of the debt brake for higher defense levies, has increased Germany’s national debt by around a third in one fell swoop.

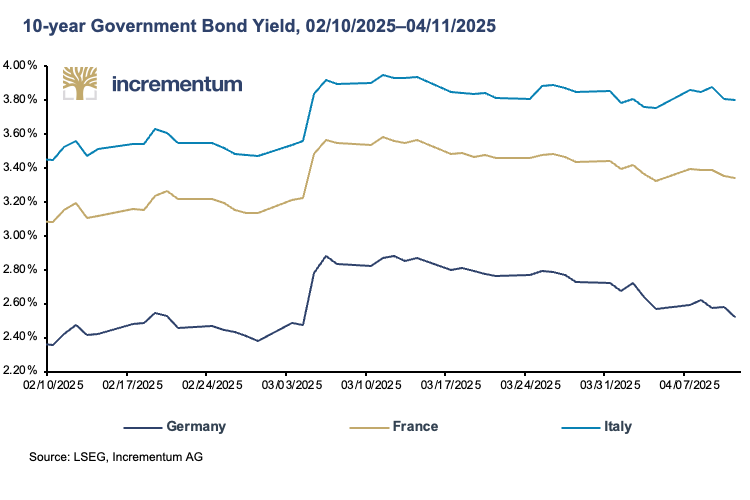

The consequences of this historic breach of a campaign promise? The yields on German government bonds shot up. At its peak, the yield on the 10-year German government bond rose by more than 40 basis points, or 0.40 percentage points, to as much as 2.93%. At its peak, this was an increase of almost 20 percent. This was the strongest rise in German government bonds in more than 30 years. As a benchmark bond, it also pushed up the yields of other countries, most of which are significantly more indebted. For France and Italy, the German turnaround will further exacerbate the already tense debt situation.

The obvious question is whether Merz is not jeopardizing the status of the German government bond as a safe anchor of the fiat financial system with this U-turn. In any case, gold offers an alternative that has been tried and tested for centuries to close the resulting gap.

Conclusion

With Donald Trump’s inauguration, uncertainty in international politics, geopolitical dynamics and the financial markets has increased significantly. It remains to be seen how long this phase will last, especially with the new factor of the US’s erratic tariff policy. What is certain is that gold is benefiting from the increased uncertainty. It is also certain that gold’s role as a neutral asset without counterparty risk has been strengthened. What is new is that gold is also increasingly being rediscovered as an economic policy instrument. Gold should also become even more attractive for investors due to the volatility and weakness of the equity and bond markets.

https://vongreyerz.gold/the-rearrangement-of-the-global-economic-order