Well-Intentioned Health Care Subsidies Are Destroying the Country

Officially, inflation is 2.9 percent. Does anyone actually believe that figure? Health care insurance premiums, rent, food, vehicle costs, tuition, electricity, and uncovered medical care all seem to be rapidly increasing far beyond the 2.9 percent official rate. Government statistics don’t matter as much as lived experiences. The things Americans spend their money on are becoming much more expensive—everyone knows it.

Over the last two years, official inflation statistics have been increasingly unreliable, and have been radically revised months after their first release. For some time now, economists have published “shadow” inflation statistics, which currently peg actual inflation at just below 8 percent. The 10-year Treasury is trading at around 4 percent per year. If you believe the official inflation statistic of 2.9 percent, holding a Treasury to maturity will return a small profit. If you think the shadow statistics are closer to the mark, you will consider holding U.S. debt a money-losing proposition.

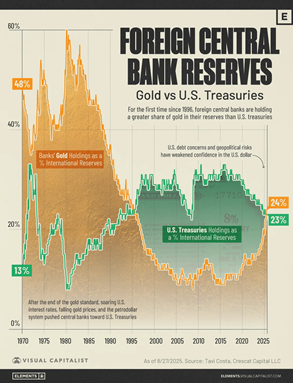

Unfortunately for advocates of more government borrowing, investors are beginning to vote with their feet. Real inflation is driven by excessive government spending and that spending is making it less attractive to loan the government money. As a result, gold has become the reserve asset of choice, displacing U.S. Treasurys. ZeroHedge recently published this chart (reposted below) from the website VisualCapitalist. Foreign central banks, for the first time since 1995, have dumped U.S. Treasurys as their dominant “safe” reserve asset.

Notice how quickly confidence in U.S. Treasurys has declined since 2020. The slope of the curve is 45 degrees down. It’s rapid and alarming. This is part of the reason why the price of gold has increased so rapidly.

Inflation, most agree, is caused by excessive government spending, particularly borrowing. But the real root of the problem today is the well-meaning desire to guarantee affordable health care to an increasingly larger portion of the population. We have reached a day of reckoning. In 2025, the federal government is projected to spend at least $1.9 trillion in combined medical expenditures, including the COVID-era Obamacare subsidies that are now expiring. In addition, in 2025, we will pay $1.2 trillion in interest on the debt. Very soon, that number will skyrocket as future bond purchasers demand higher returns on their investments. By comparison, all income tax added together amounts to $2.6 trillion. The rest of federal spending is made up mostly from raiding Social Security tax revenue and borrowing.

Again, if real inflation is around 8 percent, interest rates will need to exceed that by at least 2 percent if we are being honest about reality. That would quickly lead to interest payments that exceed all income tax.

The future involves one of four scenarios.

First, we can freeze or reduce all spending and allow growth and revenue to catch up organically. In theory, as economic activity improves, tax revenue will begin to grow large enough to allow us to manage our additional debt. There’s zero political will to take this path.

Second, we can use the Federal Reserve to buy U.S. Treasurys. The advantage of this approach is that the Federal Reserve will simply return most of the bond interest payments back to the Treasury Department. The disadvantage is that the Federal Reserve will need to create trillions of fiat money to do this, leading—almost certainly—to hyperinflation. This hyperinflation will further accelerate medical cost inflation, requiring even more borrowing to keep up.

Third, we might experience a deflationary shock, such as the 2008 banking crisis or the 2020 pandemic. The advantage of this scenario is that it could allow the Federal Reserve to buy Treasurys without creating short-term inflation. But long term, as we saw in the years following COVID or the 1970s oil shock, inflation could become severe. Moreover, in the short term, we will suffer massive unemployment. While I’m not suggesting the powers-that-be will take advantage of the impending crisis to stage such an event, to paraphrase Rahm Emanuel, an overreaction to the next crisis could aggravate it sufficiently to cause a shock. One might say, that’s exactly what happened in 2020.

The fourth scenario is the course we’re currently on. We simply continue to subsidize and spend without regard to fiscal realities. The interest payments will continue to balloon, and the day will come when nobody voluntarily lends anything to the U.S. government. All tax revenue of any kind will eventually be insufficient to service the debt, and the government will have to borrow at eye-popping interest rates just to make the payments on the existing debt. All entitlements will be defaulted upon. The military will go unpaid. And the federal government may be unable to continue to function.

The hard reality is that the American taxpayer cannot afford to indefinitely foot the bill for all of the promised health care coverage. The current government shutdown is over the renewal of COVID-era subsidies for Obamacare. These subsidies go to some of the most vulnerable citizens. Yet our sympathies must be tempered and guided by the cold fiscal realities which are about to take control of the situation. Something needs to change, or everyone is going to lose their subsidies all at once.

https://chroniclesmagazine.org/web/well-intentioned-health-care-subsidies-are-destroying-the-country