When Shorts Run Out of Continents

Something broke in the global monetary system over the past twelve months. You can see it in the numbers. You don’t even need to look that hard.

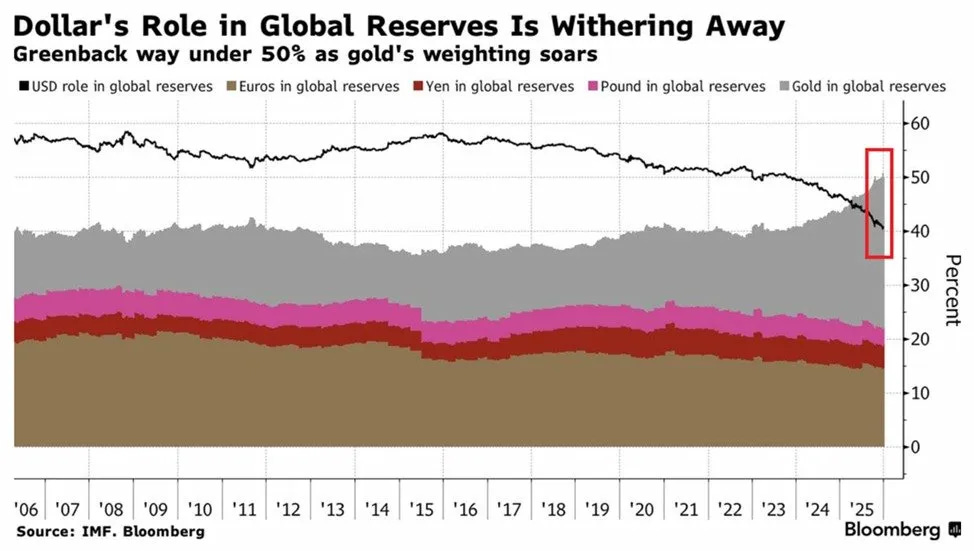

The dollar’s share of global reserves collapsed to roughly 40%. Gold jumped to ~30%. That means gold is now bigger in central bank reserves than the euro, yen, and pound combined.

This isn’t diversification. This is a flight into a neutral – non devaluing – asset. Accelerating since around ‘23.

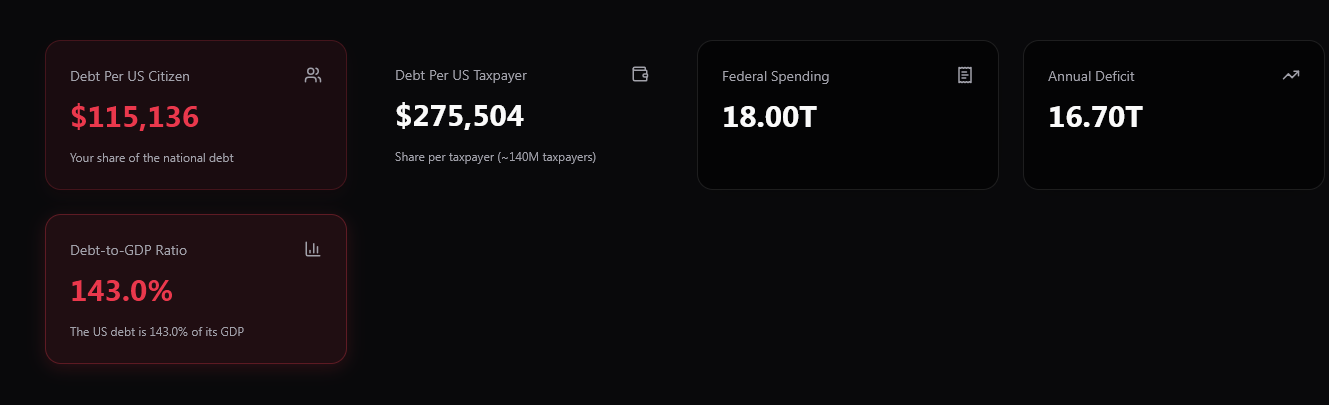

The US is adding $1 trillion in debt every 100 days. Interest payments exceed $1 trillion annually. That was more than the defense budget a few days ago. Now that budget is 50% more. Guess how it’ll be paid for? I doubt those few stolen oil tankers will cover it.

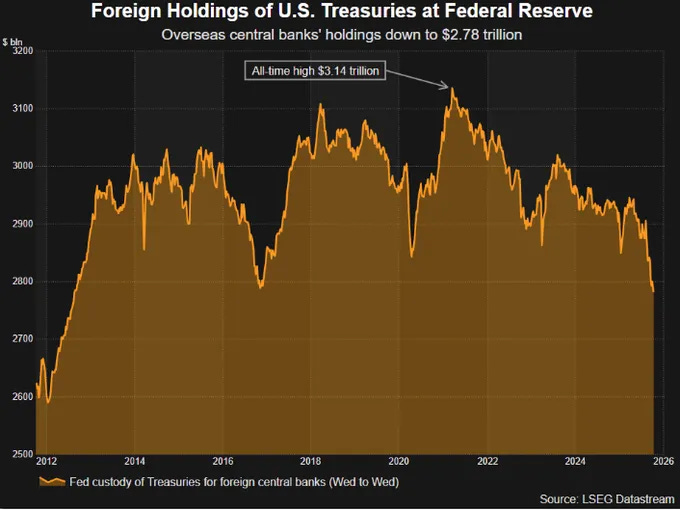

Foreign Treasury holdings dropped from $3.14 trillion to $2.78 trillion. That’s a trillion-dollar exit while the Fed restarted QE at $40 billion per month. By the way, it’s now called “reserve management purchases” because calling it ‘QE5’ is so 2008.

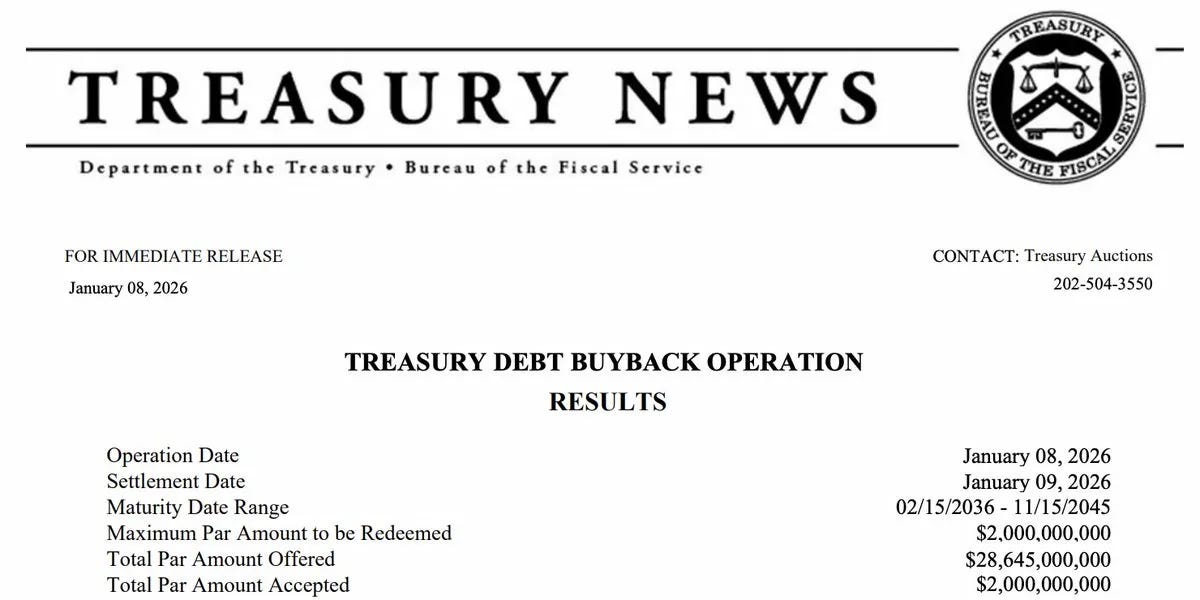

Treasury also conducted a debt buyback operation. The market offered $28.6 billion worth of bonds, but Treasury only accepted $2 billion worth. Make of that what you will.

Gold gained 65% in 2025. Best year since 1979. The dollar index fell 9.4% – worst in eight years.

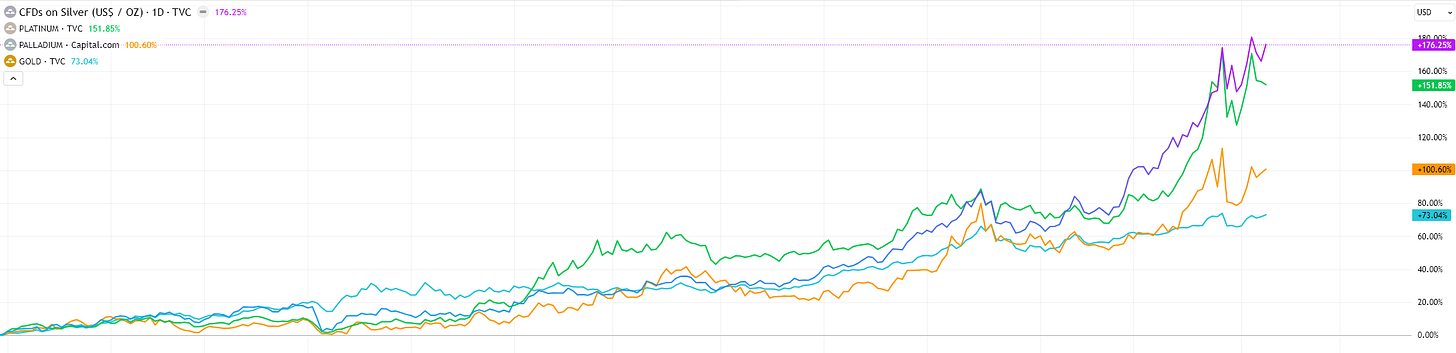

But if you think gold’s move was dramatic, you haven’t been watching silver. Or platinum. This price action started last year. I’m purely focused on monetary metals, but Ag/Pt/Pd also serve a dual role as industrial metals. These materials go into actual products. And when they start leading, you’re not watching speculation. Not entirely at least. You’re watching real-world shortages drive real-world price discovery.

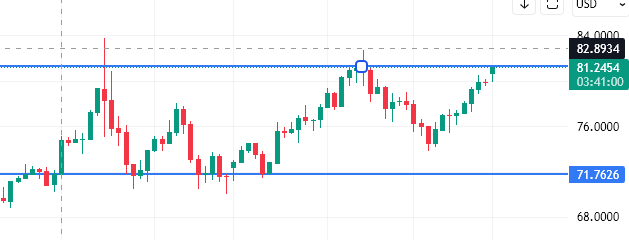

Silver closed 2025 up 150%. Trading around $80 now. Every fundamental I’m looking at screams shortage – industrial demand robust, supply deficits persistent for years, solar and EV adoption accelerating.

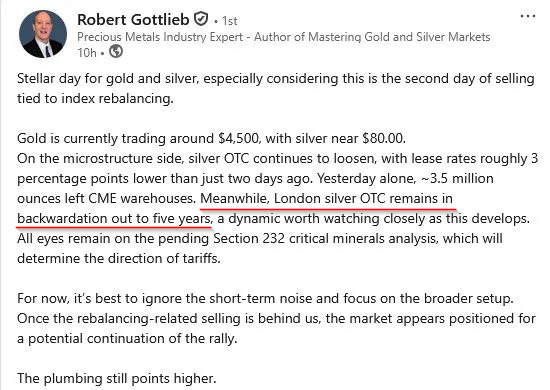

And then I read Robert Gottlieb writing the following – just read it in full:

[side note: Gottlieb spent years as an executive at JP Morgan’s bullion desk. He’s one of those people that knows exactly how much metal exists, where it sits, and what the real delivery obligations look like. When he speaks, you better listen – not believe blindly of course, but listen carefully].

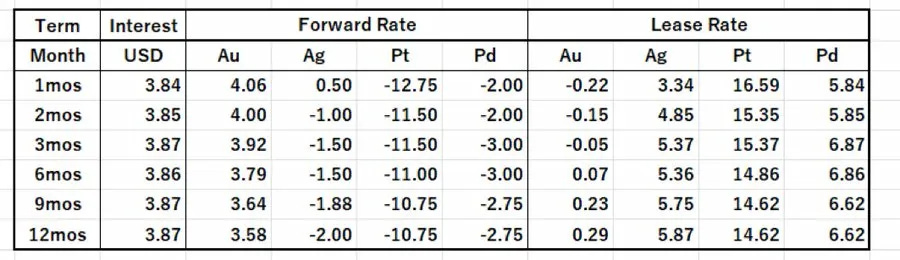

London silver OTC remains in backwardation out to five years.

Read that again. Five f***ing years.

Backwardation means spot costs more than futures. It signals the market needs the metal now, not later. Before, you could see it occasionally during temporary squeezes. Maybe a few weeks during supply disruptions. But now? This is going on for the last few months already.

And then Gottlieb drops the bombshell that it’s five fracking years of backwardation!! The market doesn’t believe any adequate supply will be available at any reasonable price until 2031.

That’s not a squeeze anymore. That’s not even a supply chain hiccup. That’s a structural scarcity priced into the curve for half a decade.

“There is no silver available above the ground, or that can be easily mined to fulfill demand for years, and those companies that must secure supply are significantly pulling demand forward.”

His conclusion? “The plumbing still points higher.”

While Gottlieb explains this structural scarcity, we only have to look East to see the physical market proving him right.

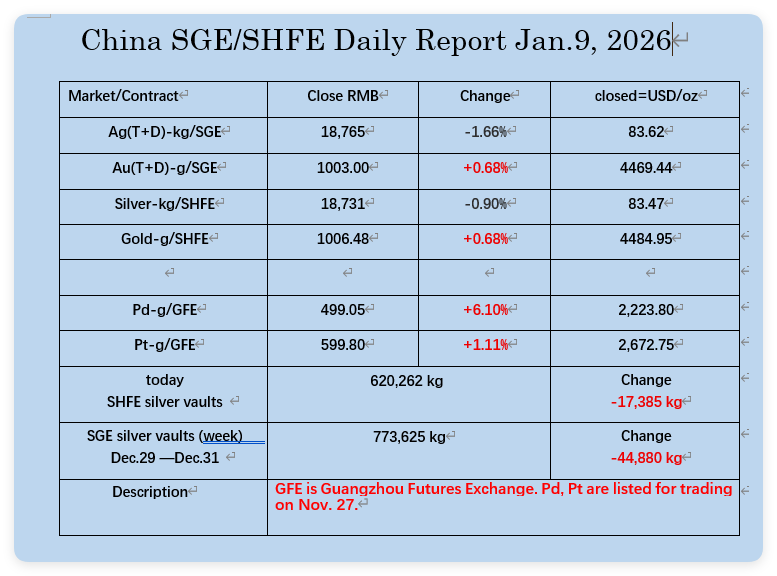

China’s spot market closed the week at $83.62 per ounce. The Shenzhen wholesale market tried to buy silver for $82 for 15kg bars. Zero sellers.

And in lala-land? $77.20.

That’s a $5+ disconnect between what people will pay for actual metal versus what the paper contract claims silver is worth. We’re watching a complete disconnect. Two markets operating in two different realities.

The metal isn’t there. Or the people who have it aren’t letting go at these prices.

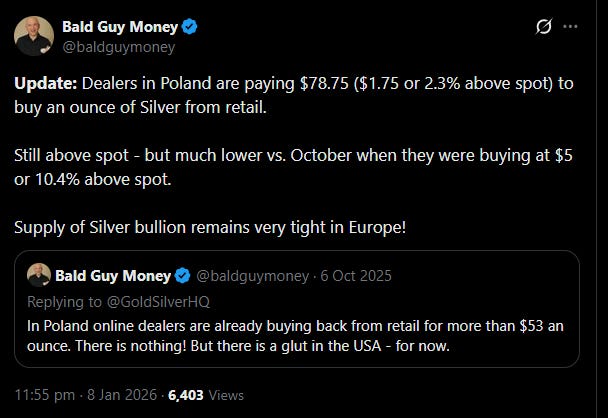

Poland shows the same dynamic. Retail buyback premiums compressed from 10.4% over spot in October to 2.3% now, but they’re still paying above spot.

The COMEX is experiencing something between a controlled demolition and a slow-motion bank run.

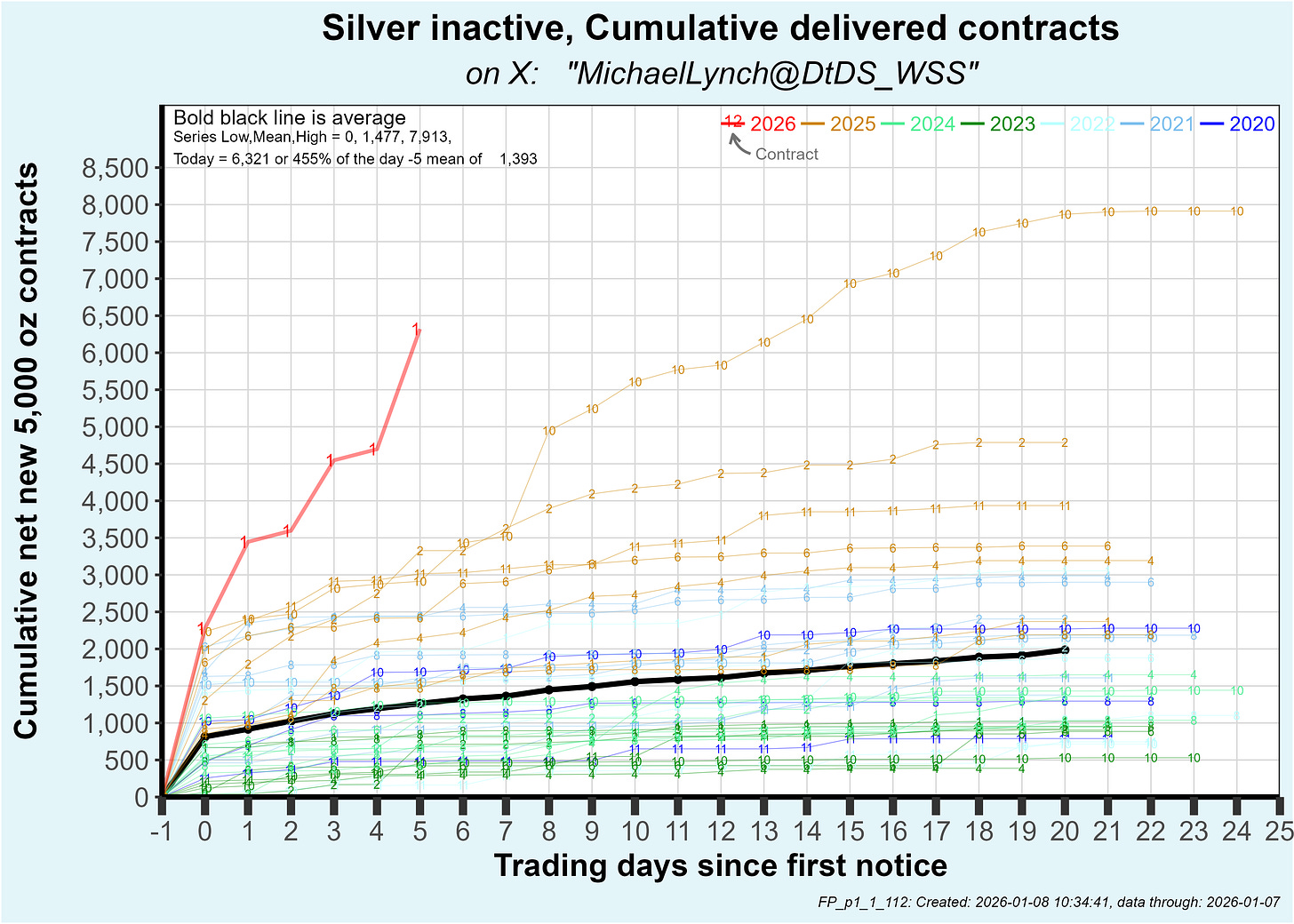

December saw unprecedented delivery volumes. And the first week of January – which is normally an inactive month, we’re looking combined at ~20,000 contracts – about 100Moz – standing for delivery. December alone was 2.5x any previous December on record. And we still have more than half a month to go in January.

January is running at triple its normal pace. In the first seven days alone, 6,321 contracts stood for delivery – that’s 31.6 million ounces. January typically sees 1,000-2,500 contracts for the entire month.

On January 8, 3.5 million ounces left COMEX warehouses. Not adjusted from registered to eligible. Left. Gone. Out the door.

On January 9, another 2.74 million ounces withdrew.

That’s over 6 million ounces drained in two consecutive days. At this pace, you’d empty the entire registered category in six weeks.

Selling pressure incoming in the next week

·

Jan 7

A few days ago, I highlighted the -now- infamous commodity rebalancing. Mechanical selling would be dumping roughly 13,000 COMEX contracts. Algorithmic liquidation. I anticipated significant downward pressure – the math suggested $5-7 billion in selling would hit the market over the next two weeks.

We’re a few days into that selling. Silver is trading around $80. Gold at $4,500.

I have yet to see any material downside! The market is absorbing billions in mechanical paper selling while simultaneously draining 3 million ounces per day of physical metal. Prices barely flinched.

This is either the most perfectly priced-in event in commodity market history, or the physical bid underneath is so strong that even massive algorithmic liquidation can’t push prices further down. When these passive index flows – the most predictable, mechanical selling in the entire commodity complex – can’t move a tiny market like silver, something fundamental has changed.

Once this rebalancing pressure lifts – probably by mid January – what happens when the mechanical selling stops but the physical demand doesn’t?

It’s different this time™

Meanwhile, COMEX is losing its role as the price discovery mechanism for silver.

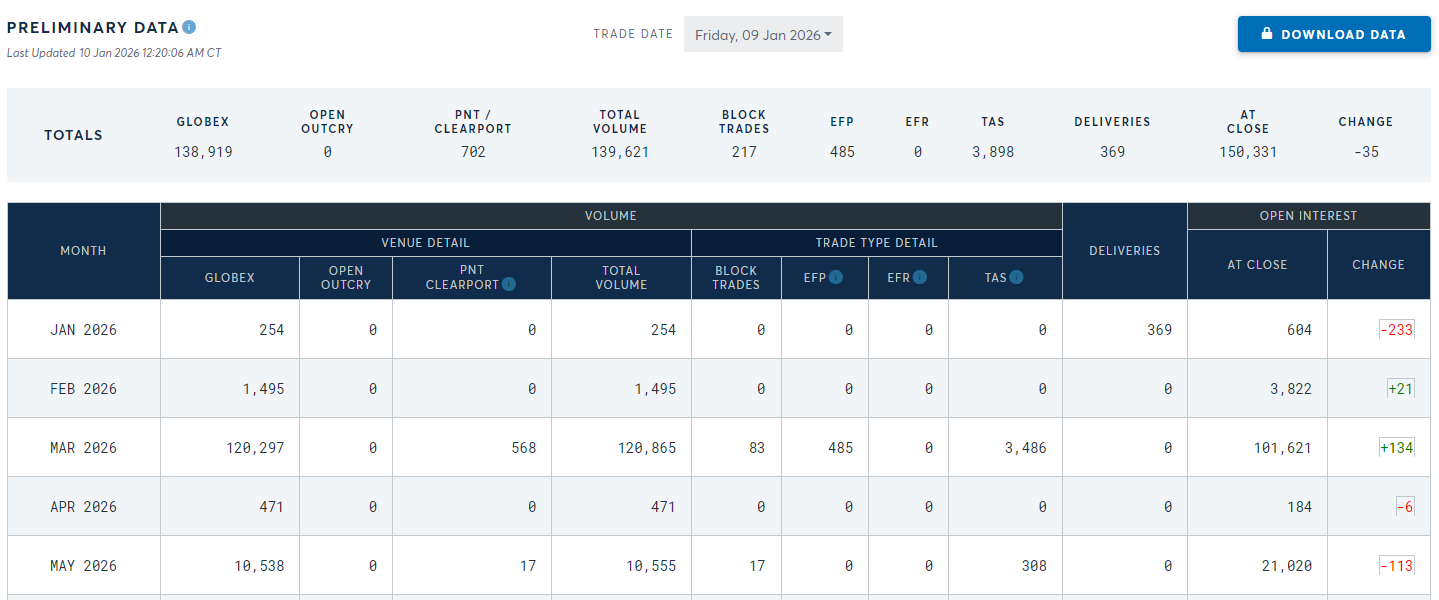

Open interest on the March contract collapsed below 102,000 contracts – down from over 180,000 earlier in the cycle. That’s the benchmark contract. The most liquid month. Where price discovery is supposed to happen.

Friday was Non-Farm Payrolls. One of the biggest economic data releases of the month. In “normal” situations, markets see massive volatility and repositioning as traders react to employment numbers and Fed implications.

Those silver March contracts? About 120,000 traded. Total open interest changed by 134 contracts.

…

Major economic data that historically triggers thousands of contracts in repositioning, and the market just ignored the COMEX. The volume was there, but almost no new positions opened or closed.

Just algos trading the same papers back and forth.

I’m going to call it. The COMEX is losing relevance. Fast. Trading volumes are shrinking where they matter most. Physical delivery is overwhelming the system. And price discovery is shifting to China (and other physical markets).

Remember that Thanksgiving outage? November 28, COMEX went offline for 10 hours due to a “cooling system failure” right as silver was breaking out above $54. Ten hours of darkness while the biggest derivatives exchange in the world couldn’t discover prices.

When it came back online, silver exploded to new highs. But registered inventories barely moved after that night. Almost like someone needed time to reorganize things.

Since Thanksgiving, deliveries have piled up. December set all-time records. January is running triple normal. Yet registered metal sits around 124 million ounces, roughly where it was before the outage.

If those delivery notices had actually resulted in metal leaving the vaults, COMEX would be empty. Just stating facts. Draw your own conclusions.

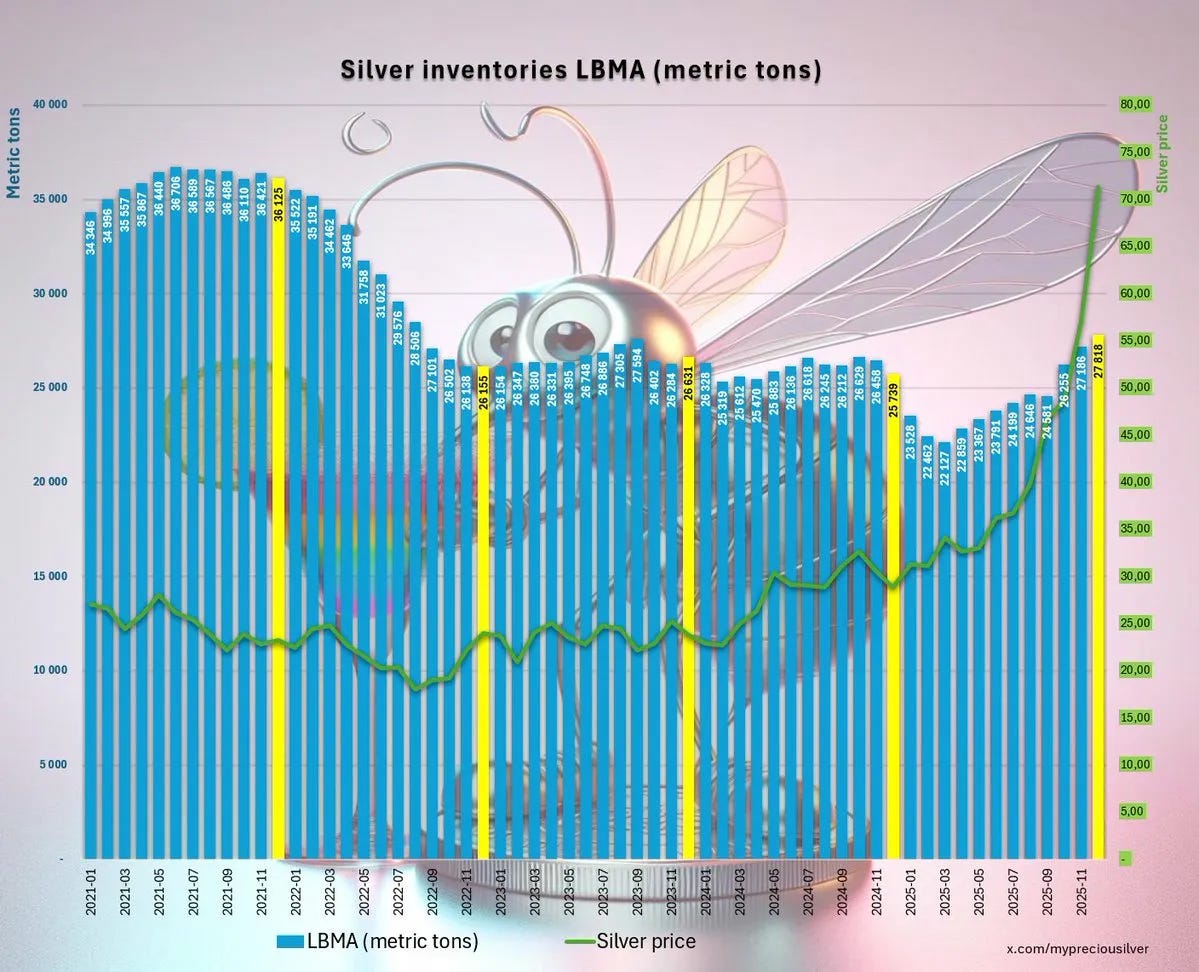

The LBMA wants you to believe everything is fine.

They reported a 20 million ounce increase in December inventories. Apparently silver grows on trees in London now. That would explain many things, except the UK government’s disastrous finances.

All joking aside, just let me get this straight. China paying $5 over spot, with no sellers. COMEX deliveries are tripling. And somehow London found 20 million ounces just sitting around?

If metal was actually flowing back, those pesky lease rates should be collapsing. Supply relief should show up in the forward curves.

Instead, lease rates dropped 3 percentage points in two days as emergency flows arrived from COMEX and SLV – but London OTC remains in backwardation out to five years.

COMEX shipped 7.3 million ounces back to London since January 1st. SLV got raided for 11 million ounces. That’s 18.3 million ounces of relief in a week. Enough metal to provide temporary breathing room on lease rates.

Not enough to fix the five-year backwardation. Not even close.

Now let’s talk about a potential bear trap I’ve noticed.

Months ago (at least since October) traders were piling into SLV $70 strike calls. “Smart money” convinced the plebs that silver had topped. Whilst probably gobbling up those dirt-cheap OTM calls themselves.

However for every long, there is a short. And they’re loosing money. BIG time. Because a sold call option has unlimited losses. The first margin call should have happened around $73.50 (5% stoploss).

In the past two months we saw 2 tries to crush this massive pile of calls. Typically done in illiquid overnight markets – short covering plus gamma squeeze in thin trading.

It failed. Twice.

So who you gonna call? GhostBusters?

1st helpline: the COMEX? Nah. It’s draining already 3M oz/day.

LBMA? Five-year backwardation. Gottlieb says there’s no metal available above ground.

Let’s ask our Chinese friends? SGE requires either physical delivery or forced buyback. If our shorts try to source metal from SGE to deliver against COMEX obligations, they’ll hit the same wall. SGE is tight. And at a premium to COMEX.

To offset a short position on SGE, you must buy to close. Buying pushes SGE prices higher. Higher SGE prices create more arbitrage with COMEX. And round and round it goes. Physical flows from COMEX to China. Which is already happening, obviously, given the 6 million ounces that just left in two days.

The shorts are trapped in every venue. No escape.

The system’s response to this physical tightness? Let’s create moar paper.

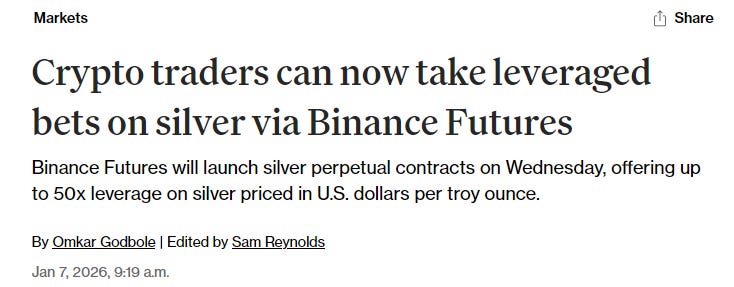

On January 7, as COMEX deliveries were running triple normal, as lease rates were screaming supply stress, as physical markets showed historic premiums… Binance launched 50x leveraged silver perpetual futures.

The timing is… peculiar.

Paper silver. No delivery. No storage. No physical constraint. Just pure price exposure with 50x leverage, margined in Tether.

When metal gets scarce, derivatives multiply. Every. Single. Time.

Fifty times leverage creates liquidations. Volatility. Fake price discovery. Short-term suppression while the physical market does its thing in the background.

You can trade a billion ounces of “silver” on Binance. None of it real. None requiring metal. But it contributes to price action. Shows up on the charts. And it affects the sentiment.

It creates the illusion of supply without creating actual supply.

This doesn’t help bullion banks in the long-term of course. It simply buys them time. Maybe six months. A year if they’re lucky. But you can’t deliver a Binance perpetual contract to a solar panel factory. At some point, someone needs actual metal.

And there isn’t enough. (As I keep repeating… Constantly…)

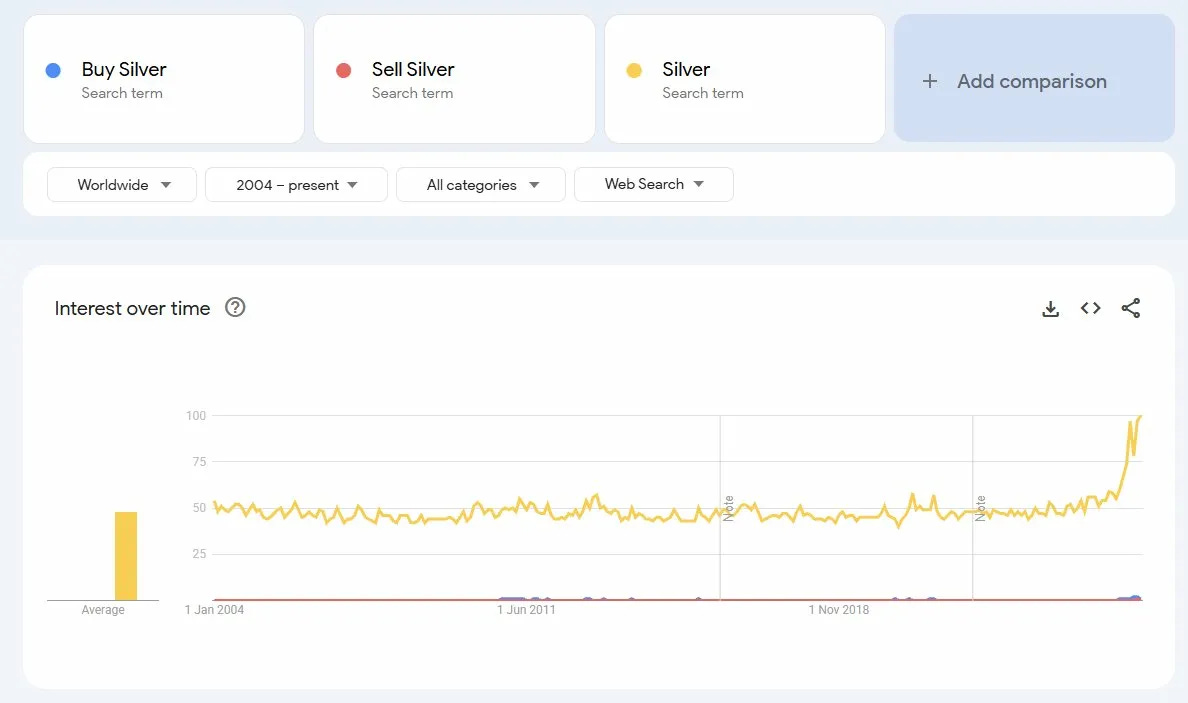

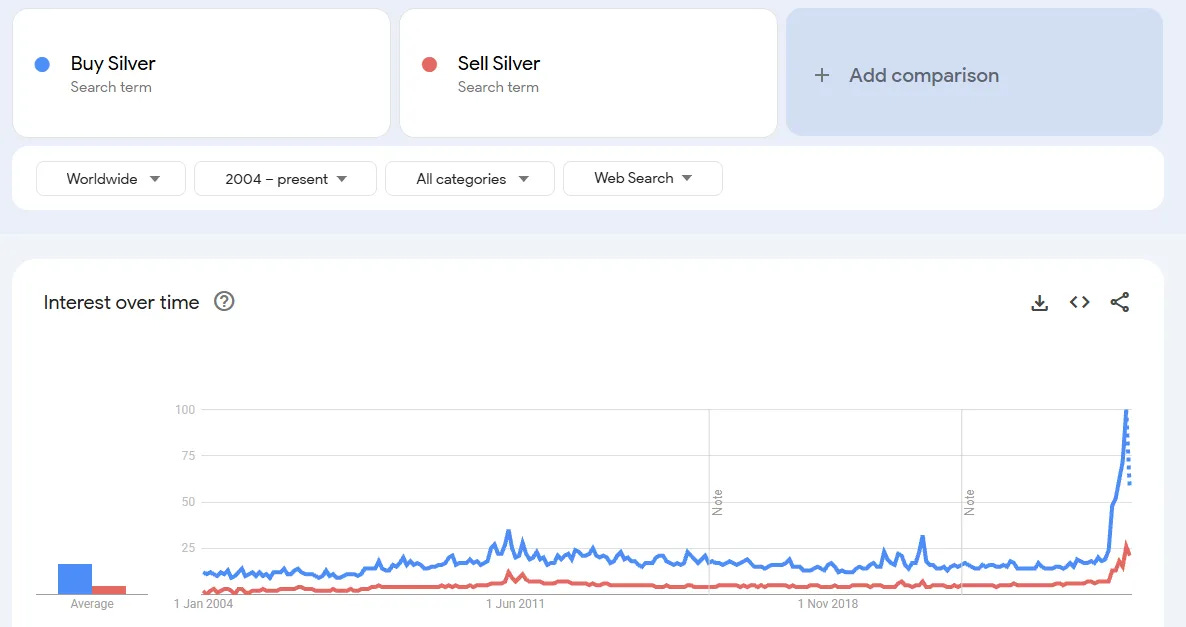

Want to know what’s really happening? Look at what regular people are searching for:

Google Trends shows “Silver” searches doubling from long term average. “Peak” interest levels. “Sell Silver” searches? Flat. Barely registering. “Buy Silver” slightly higher. Only the smarter retail people are searching for it. A tiny sliver of the population.

The skew between the 2? Not that much people that want to let go of their metal despite a 150% rally.

Retail FOMO is barely registering. Not peaking. Starting. Barely.

Bank of America published their 2026 outlook last week. Analyst Lawson Winder sees gold averaging $4,538 for the year, with production falling 2% and costs rising 3%.

But the interesting part is silver.

The current gold-to-silver ratio sits around 59x. Winder notes that past cycle lows in the ratio – 14x in 1980 and 32x in 2011 – imply significantly higher silver prices at today’s gold levels.

Using the 2011 low (32x), silver would equate to roughly $135 per ounce.

Using the 1980 low (14x), silver would be $309 per ounce.

That’s without assuming any further appreciation in gold. Just ratio compression back to historical cycle lows.

The 28-year broadening wedge from 1998 is breaking down. We bounced off 54 support recently. That level failed. Next stops: 41 (the 1998 low), then 21 (connecting 1998 and 2011 lows).

If gold hits $5,500 and the ratio drops to 41, silver is $134.

If gold reaches $8,000 and the ratio compresses to 21, silver is $380.

Silver spent most of human history between 10:1 and 15:1 relative to gold. We’re at 59:1 today. Reversion to the mean doesn’t happen gradually. It happens violently.

You know what’s fascinating? We obsess over the gold-to-silver ratio, chart it, trade it, theorize about manipulation… but we rarely ask the more basic question: how did we get here? Queen Puabi of Ur went to her grave in 2600 BCE wearing a golden headdress weighing several pounds, surrounded by golden lyres and vessels. Her silver? Probably spent bef…

The world is getting more and more unpredictable with every day. Kidnapping of Maduro in Venezuela. Talks about buying Greenland. Whispers about an impending attack on Iran. Russia mopping up the Ukrainian “volunteers”. Potential AI bubble imploding. Assets being confiscated (Russia’s Treasuries and Venezuelan gold comes to mind).

But there are silver linings (pun intended)…

There is gold – a monetary metal that doesn’t do anything. Which is great in turbulent times.

There are the dual metals (monetary/industrial): silver, palladium, platinum which are severely mispriced. Even now (see my “weekend thoughts” for an assortment of graphs).

As Gottlieb puts it: ignore the short-term noise and focus on the broader setup. At current drain rates from COMEX and LBMA, the free float runs dry in a few months. That’s not total inventory. That’s liquid, available-for-delivery metal that can move between jurisdictions.

The people who understand this are already positioned. The central banks know better than to “invest” in a deprecating asset that can be confiscated at will. The Chinese know it. The Russians experienced it.

The people who think they’re clever shorting SLV calls because “volatility mean-reverts”? Well… Maybe they’re not so clever?

However, if the S&P cracks, silver’s next move is probably down initially – forced liquidation to cover margin calls elsewhere. But that dip? That’s the last chance to get physical before the real move starts.

Because once confidence breaks, once central banks can’t hold those yields down, once the foreign bid for Treasuries disappears entirely, where does money flow?

Into more dollars? More debt? Bitcoin? Assets backed by nothing but confidence in institutions that spent 50 years eroding that confidence?

Or into metals that the industry needs, which are in structural deficit, that can’t be printed, and in silver’s case: that’s showing five-year backwardation, and that historically preserves wealth when monetary systems collapse?

Silver ran 150% in 2025.

And the squeeze hasn’t even started yet.