Your Bank Doesn’t Have Your Money

When infinite paper meets reality.

Remember Greece in 2015? Banks closed. ATMs limited to €60 per day. Then €50. People queuing for hours to withdraw their own money from their own accounts. Pensioners fainting in bank lobbies. Businesses unable to pay suppliers. The economy grinding to a halt because nobody could access cash.

That wasn’t theoretical. That was real people discovering they were unsecured creditors in a banking system that had taken exorbitant risks with their deposits.

And I have a feeling it’s about to happen again. Not specifically in Greece. In banks across Europe that you’ve never heard were in trouble. Because they made bets on the two most boring asset classes imaginable.

A metal. And bonds.

Your deposit isn’t sitting in a vault with your name on it. It’s part of a giant pool that banks use to make investments, provide liquidity, and generate returns. When those investments go bad, your deposit becomes a liability banks can’t honor. You become an unsecured creditor standing in line behind secured creditors who get paid first.

The secured creditors are the big institutions. The prime brokers. The derivatives counterparties. They get the collateral pools. They invoke their legal priority. They take everything.

You get a number in a queue. And maybe €60 a day if you’re lucky.

A tad dramatic maybe, but that might be what’s coming… And silver might be the fuse that lits it.

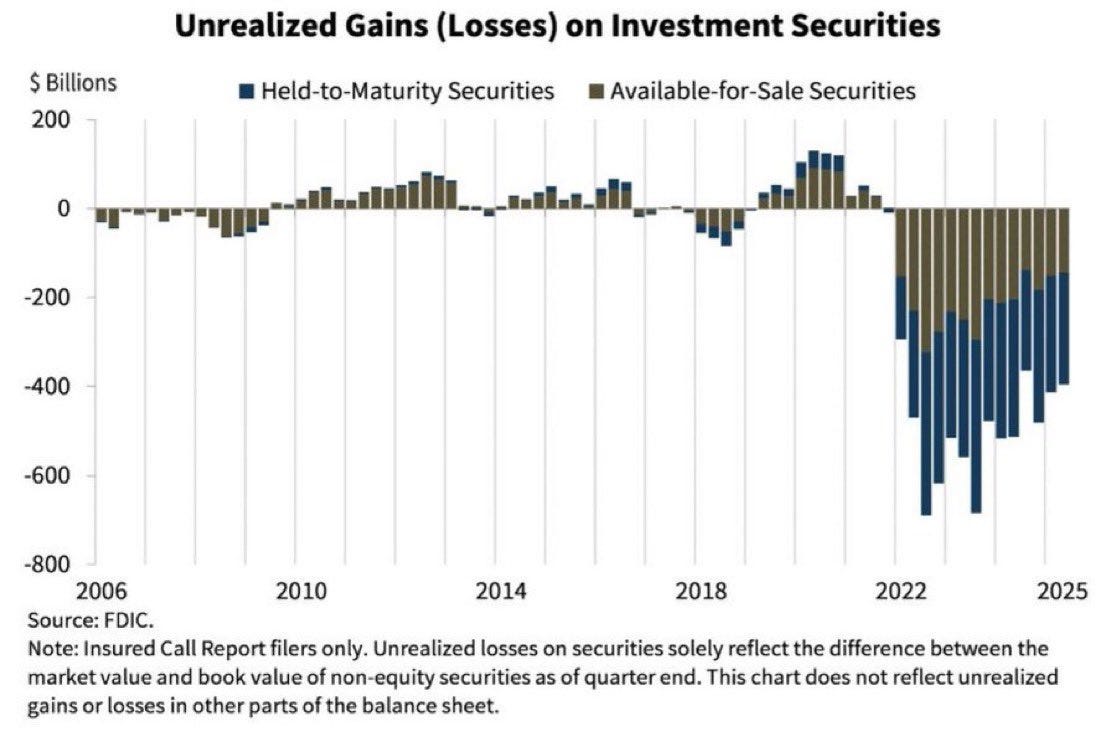

Banks – both US and EU – have been sitting on this powder keg for years. Those bonds they bought when rates were near/sub zero? They’ve been underwater since central banks started hiking in 2022. The most recent comprehensive data – from September 2023 – showed unrealized losses on euro area bank bond portfolios averaged 30% of book equity. Some banks hit 60%. And with rates remaining elevated through 2024 and 2025, those losses haven’t disappeared. They’ve just been quietly festering on balance sheets, hidden by “hold to maturity” accounting.

That’s the simmering fuse. Billions in unrealized losses. Years of exposure. Banks praying rates come down before they need liquidity.

And now silver adds accelerant.

Derivatives desks were shorting silver. According to SprottMoney, several non-US (likely European) banks hold significant short positions. Paper contracts on the assumption the price stays manageable and contracts settle in cash. Standard market-making. Collect fees. Provide liquidity. Nothing exotic.

Two boring trades. Bonds and silver. Conservative assets. What could possibly go wrong?

Everything.

Central banks started hiking rates. Those “safe” bonds are now deeply underwater. Billions in losses that don’t appear on balance sheets as long as banks don’t sell.

And silver? It opened 2025 at $29.59 per ounce. It closed Friday at $79. Up 167% in twelve months.

Banks that shorted at $29.59 and held are now facing 167% losses. On a €1 billion notional position, that’s €1.67 billion in losses. And it’s getting worse daily. Silver hit new highs last week. China announced export licensing requirements starting January 1st – 121 million ounces of annual exports now require government permission. CME hiked margin requirements to $25,000 effective Monday, forcing more collateral calls.

Why is this a story about more than just silver and bonds? It’s about how the entire system is cobbled together. When the margin calls hit on those silver shorts, banks will need collateral. And what collateral do they have? Yep, you guessed it. Those underwater bonds.

Selling the bonds crystallizes the losses. Not selling means they can’t meet margin requirements. Either way, you’re insolvent.

This is the exorbitant risk European banks are running with your money. Not their money. Yours.

They took your deposits and shorted silver at $29.59. They took your deposits and bought bonds yielding nothing. And when both trades went catastrophically wrong, they didn’t close the positions. They doubled down. They held. They prayed. They gambled that silver would drop and rates would fall and everything would return to normal.

With. Your. Money.

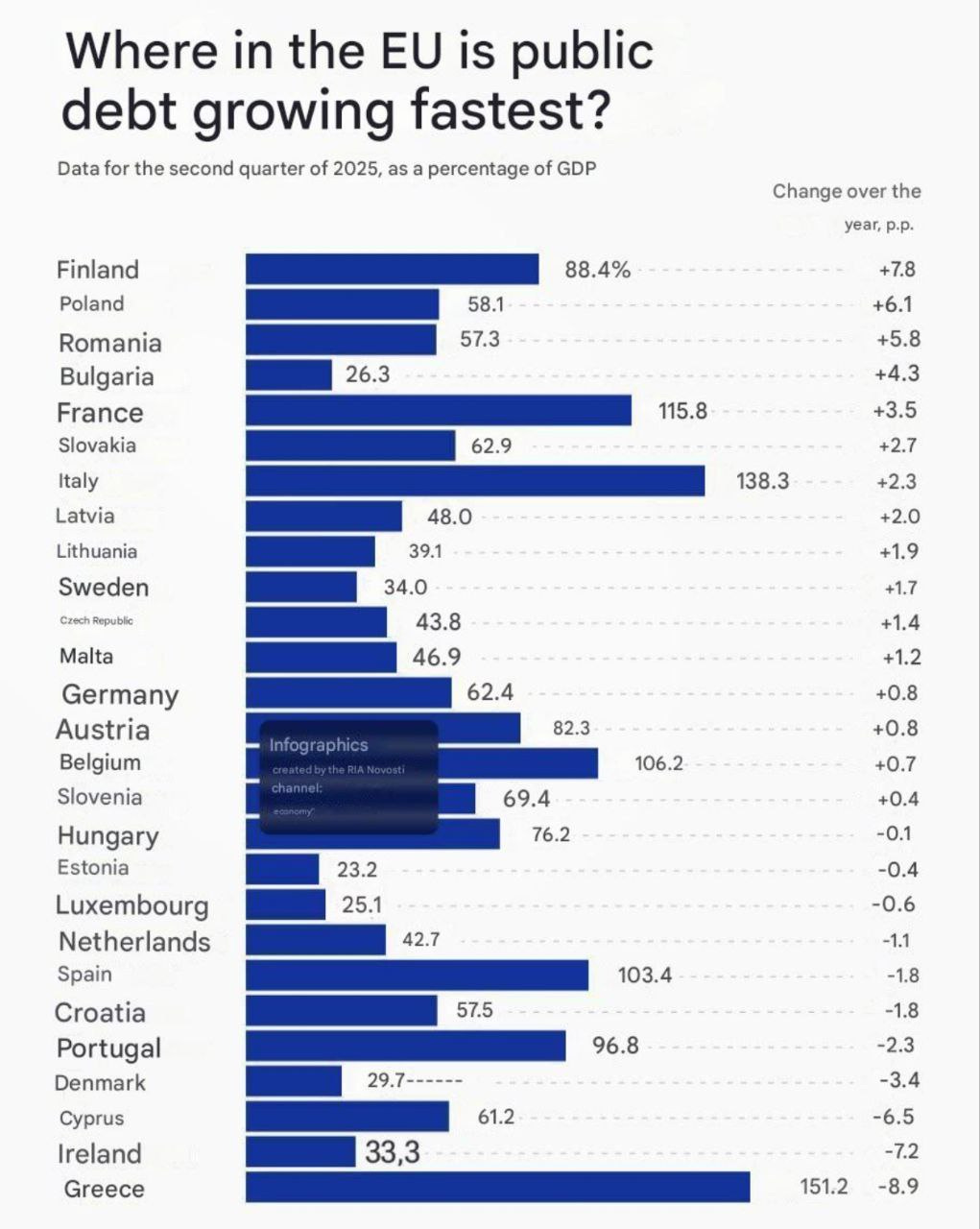

But silver is just one possible trigger. The bonds could blow up on their own if rates spike again. A sovereign debt crisis in France, Belgium, Italy or Spain could detonate it – take a dart and throw it at the EU map – any country is insolvent. Commercial real estate implosions. Any number of fuses could light this powder keg.

What matters is what happens when it blows.

The physical silver markets show exactly how close we might be to one possible ignition point. London OTC markets – where banks actually trade physical metal – show deep backwardation. You get paid MORE for metal today than promises of metal tomorrow. That’s extreme stress. Shanghai physical is trading at $85. Dubai at $91. COMEX paper sits at $79 pretending everything is fine.

Someone’s lying. And in my experience, it’s never the physical market.

Silver can run to $134 before solar manufacturers – the primary industrial demand driver – even begin reducing consumption. That’s the breakeven where solar industry profits hit zero and they start considering copper substitution. But copper substitution takes 4 years minimum to implement across 300 global factories. The industry can’t switch fast enough even if silver hits $134 tomorrow. [source]

From $79 to $134 is another 70%. Banks short from $29.59 would be facing 353% losses.

No institution survives that while simultaneously sitting on bond portfolios underwater by 30% of equity.

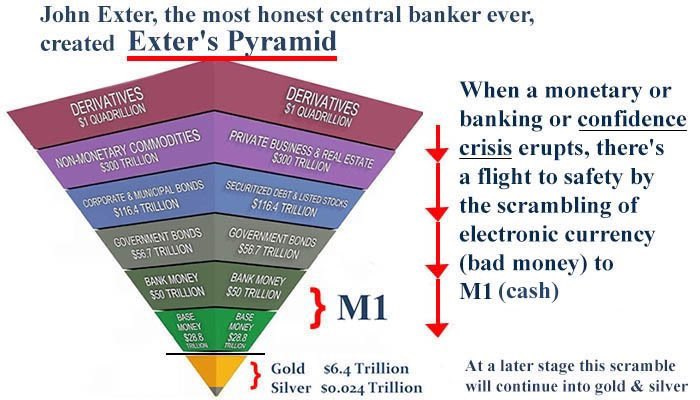

But this isn’t really about silver. Or bonds. It’s about derivatives.

The derivatives market is what turns individual bank failures into systemic collapse. It’s what connects European banks to American banks to Asian banks in one massive, interconnected web of counterparty obligations. Trillions in notional exposure. Rehypothecated collateral pledged multiple times. Where one failure doesn’t just hurt that institution – it cascades through every connected entity.

Deposit insurance works when one or two banks fail. It doesn’t work when the derivatives network detonates the entire system simultaneously.

There’s a reason Silicon Valley Bank, Signature, and First Republic were made whole at 100%. The regulators saw the contagion risk. They saw what happens when depositors panic and run.

If one major European bank goes under from silver shorts or bond losses, the contagion could spread instantly. Margin calls ripple through the system. Counterparties scramble. Secured creditors seize collateral pools. Other banks panic.

Chaos isn’t easy to control. One failure reveals exposure at three other institutions. Those three reveal exposure at ten more. And suddenly everyone realizes nothing got resolved since 2008. It only got worse. Papered over. The system is rotten to the core.

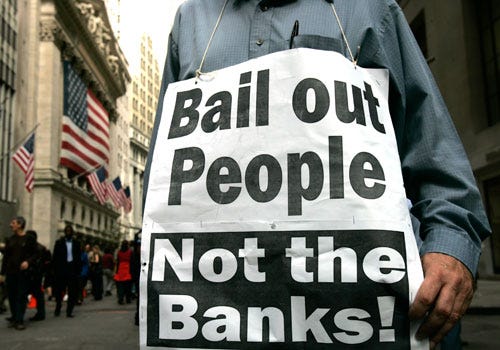

So who pays when – if – this blows?

Governments will try to bail them out. Of course they will. They’ll announce “emergency measures” and “liquidity facilities” and “temporary support programs”. The system will be deemed “too important to fail” while your account is frozen. Regulators will promise “reforms” and “investigations” whilst you can’t access your savings.

But European governments are already drowning in debt. Italy’s debt-to-GDP is 138%. France is at 115%. Spain 103%. Greece 151%. They don’t have the money. They’ll print it anyway, but that just devalues the currency further. Your euros worth less while your deposits are frozen.

If this blows – and I hope it doesn’t, but the risk is real – your deposit becomes a liability they can’t honor. Your savings become numbers on a screen you can’t access. Your account becomes a queue position behind secured creditors who take everything first.

This is the rage of it. The evil of it. Banks gambled with your money on positions they didn’t understand. They’re trapped in losses they can’t exit. And when it all collapses, you pay the price.

The traders who made these bets? They’ll probably find a tall building and learn to fly. The short way out. The executives? They get golden parachutes. The shareholders? They saw the quarterly reports and could have sold.

But you? You trusted that “savings account” meant your money was safe. You believed deposit insurance would protect you. You didn’t know you were an unsecured creditor in a derivatives casino.

JPMorgan apparently figured this out. Reports suggest they closed their 200 million ounce silver short and went long 750 million ounces of physical. The biggest hoard in history. They saw institutions trapped in positions they can’t exit and positioned accordingly.

Smart money exits before the collapse. Fragile banks keep holding, keep hoping, keep taking exorbitant risks with deposits they don’t own, betting on rallies stopping and rates stabilizing and everything returning to normal.

Until it doesn’t.

If this blows – and I hope it doesn’t – the real losses won’t be measured in billions on bank balance sheets. They’re measured in pensioners fainting outside closed banks. Small businesses that can’t make payroll. Families that can’t buy groceries because the ATM says €60 maximum and the limit keeps dropping.

This isn’t conspiracy. This is consequence. Banks reaching for yield in zero-rate environments. Treating derivatives as magic money machines with no counterparty risk. Regulators allowing “hold to maturity” accounting to hide catastrophic losses. A system that treats your deposits as bank assets to be gambled rather than customer property to be protected.

And you pay for their incompetence. Their greed. Their stupidity.

Not the traders. Not the executives. Not the shareholders.

You.

Look, I’ve been waiting for this house of cards to collapse since 2012. I’ve been wrong about the timing for over a decade. The system is more resilient than I gave it credit for. Or more accurately – regulators are better at papering over cracks than I imagined possible.

But resilient isn’t the same as stable. And papering over isn’t the same as fixing.

The powder keg is real. Derivatives connecting fragile banks across continents.

Your. Bank. Doesn’t. Have. Your. Money.

It has exposure. Counterparty risk. Underwater positions it can’t exit without vaporizing equity.

Maybe rates drop and bonds recover. Maybe silver crashes and shorts escape. Maybe I’m wrong again and we muddle through for another decade.

But the system isn’t getting stronger. It’s getting more fragile. More interconnected. More dependent on nothing going wrong.

Greece 2015 wasn’t ancient history. It’s a preview. Portuguese depositors. Spanish depositors. Italian depositors. German depositors if Deutsche Bank’s books detonate.

€60 a day. If you’re lucky.

https://no01.substack.com/p/your-bank-doesnt-have-your-money